CEO economic optimism softens as business growth remains strong, according to 2018 November WSJ/Vistage survey

CEO economic optimism continues its slow decline.

Despite strong business growth, overall economic optimism among CEOs continues its slow decline reaching the lowest level since November 2016 according to the latest WSJ/Vistage Small Business CEO Confidence Index survey. The Confidence Index was 106.3 in November, and while that is in line with last month’s index of 106.9, it has fallen past November’s index of 112.5.

Analysis by Dr. Richard Curtin, a researcher from the University of Michigan, revealed that the slow decline in this index over the past year has been concurrent with an expected slowdown in the pace of economic growth by CEOs of small firms. If you consider that the economic growth rate for 2018 is 3% so far, maintaining the current pace of growth would be good news.

While tax cuts and spending increases will continue to boost the economy into 2019, other factors loom on the horizon, including rising interest rates, falling stock prices, softened home and vehicle sales, and heightened uncertainty about tariffs and international growth.

Government policy and potential gridlock fuel fears of slowdown in national economy …

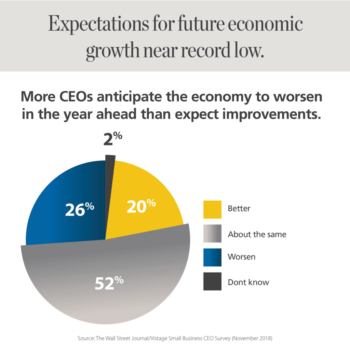

Even though the pace of GDP growth was strong in Q2 and Q3, an increasing number of CEOs are anticipating an economic slowdown in the year ahead.

According to the November survey, just 20% of CEOs expect continued improvement in the national economy, which is a significant drop from a recent peak set in January. Only twice before has the outlook dipped to these levels. Dr. Curtin notes that the common element in those dips is the reaction of small firms to government policies or gridlock.

More than one third (35%) of CEOs report negative impacts of tariffs, and 29% of CEOs believe the result of the midterm elections will impact the national economy.

… yet business growth prospects remain strong for small firms.

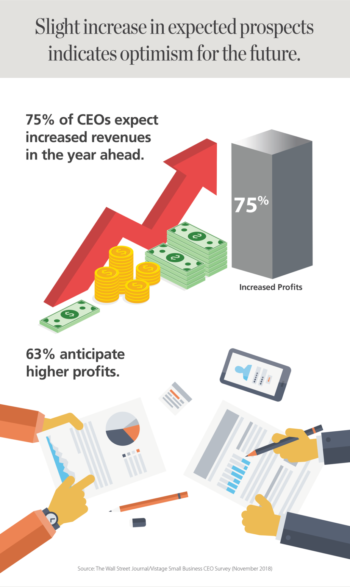

Despite their view on the future of the economy, CEOs are optimistic about their own companies. The majority of respondents said they expect increases in both revenues and profits for their companies in the year ahead:

- 75% of CEOs expect increased revenues in the year ahead.

- 63% of CEOs anticipate higher profits.

Increasing costs may be driving the gap between revenue and profit expectations; over one-third (35%) of CEOs reported a negative impact of tariffs on their business.

However, this has not put a damper on attracting new business, as more than half (51%) of CEOs reported that the number of customer inquiries and sales leads is higher than in last year.

Talent remains a key focus to address expansion.

With increased customer inquiries and strong revenue expectations, talent remains critical for small firms to accommodate growing customer demand.

More than 6/10 (61%) CEOs are planning on workforce expansion in the coming year.

In the face of a tight labor market, CEOs are exploring different tactics to attract and retain top talent. While many small firms are improving their overall compensation packages by boosting wages (59%) and adding benefits (37%), developing the skills and capabilities of their existing labor force continues to be one of the top ways that CEOs have addressed hiring challenges. More than 60% of CEOs are focused on development programs to create the talent they need internally.

CEOs also stress that onboarding the right people is as important as wages and training. More than two-thirds (68%) of CEOs indicate that it is very important to select employees who fit their firm’s values and culture.

The WSJ/Vistage Small Business CEO survey reflects the sentiment of CEOs of companies with $1-20 million in annual revenue and measures components tied to the economy, prospects for their business and plans for expansion.

Category: Economic / Future Trends

Tags: Business Growth, midterm elections, workforce expansion, WSJ Vistage Small Business CEO Survey

Great info here Joe, this brings hope for us!