Eight Critical Success Factors For Improving Strategy Execution – Part 1 of 4

Improving strategy execution is at the top of the list of important issues for most corporate executives, followed by concerns about actually having a sound strategy. When strategic planning is done well, with a mature and robust process that guides the effort to ensure completeness – the outcomes can be powerful and position an organization to thrive and sometimes even dominate the competition. Yet only a small percentage of organizations operate with mature planning models that yield complete and comprehensive strategic plans addressing alignment to key dimensions of the business. Not surprisingly, even fewer organizations have mastered the art of fully and successfully executing corporate strategic plans. With successful strategy outcomes continuing to be an elusive prize sought by so many corporate leaders, this four-part article series is focused on exploring eight critical success factors related to improving strategy execution.

Improving strategy execution is at the top of the list of important issues for most corporate executives, followed by concerns about actually having a sound strategy. When strategic planning is done well, with a mature and robust process that guides the effort to ensure completeness – the outcomes can be powerful and position an organization to thrive and sometimes even dominate the competition. Yet only a small percentage of organizations operate with mature planning models that yield complete and comprehensive strategic plans addressing alignment to key dimensions of the business. Not surprisingly, even fewer organizations have mastered the art of fully and successfully executing corporate strategic plans. With successful strategy outcomes continuing to be an elusive prize sought by so many corporate leaders, this four-part article series is focused on exploring eight critical success factors related to improving strategy execution.

CSF #1: Do a current-state analysis before jumping into future-state planning

A common mistake organizations make during strategic planning is that over jumping directly into planning for the future. That may not sound like a mistake at first blush, after all…isn’t strategic planning all about the future? The current-state analysis phase of corporate strategic planning involves gaining a realistic perspective of where the organization is today so that it is possible to plan effectively for moving from the current reality to the desired future. Missing this step puts the strategy and the execution in jeoprady. It helps put everything about the organization into a singular context – with a holistic-360 degree, multi-dimensional view that allows for comparability and planning to occur effectively.

Sometimes organizations feel that they are adequately addressing the current-state by performing a traditional SWOT analysis to provide indications of Strengths, Weakness, Opportunities and Threats. The current-state analysis prescribed here provides far more relevant attribution of the organization and the environment in which it must operate (the business ecosystem) – inclusive of critical aspects, such as: the organization’s culture, structure and core values as well as the relationships with customers, partners, employees, suppliers.

Likewise, current-state analysis is reflective of the economic fluctuations that occur within that system we refer to as the business ecosystem. The assessment yields a more complete picture of the organization’s strengths and weaknesses, and the same is true for the external assessment. Far more is understood and uncovered relative to opportunities and threats using this approach than when using the more traditional SWOT analysis.

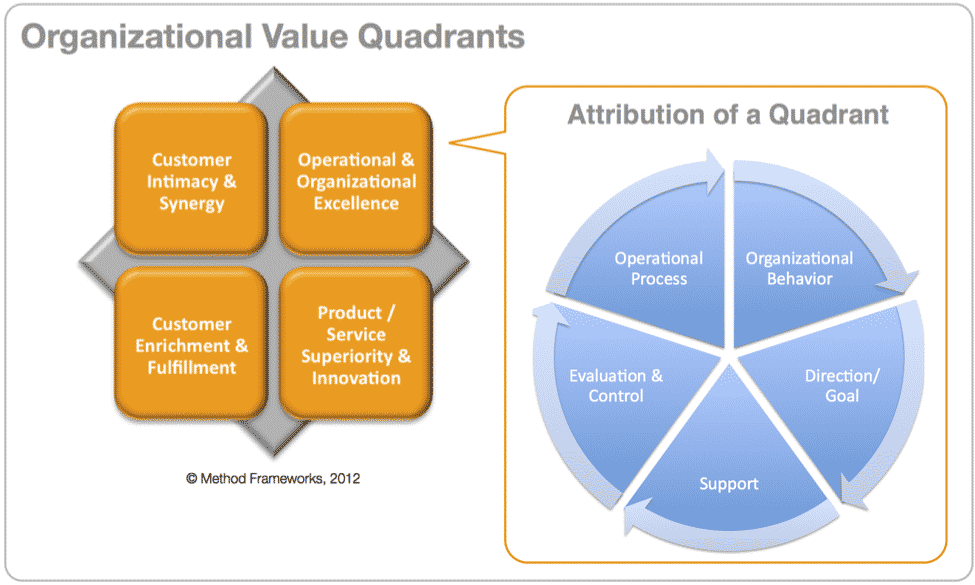

A Value Quadrant Analysis (VQA) is an excellent method to truly understand key buyer segments by profitability. Such an understanding allows a business to make informed decisions to drive sales and marketing related strategies – even helping make key decisions related to remaining in one or more quadrants or exiting unprofitable segments. In short, VQA during current-state analysis drives value proposition messaging, strategy development and ultimately should determine strategic investment decisions. (see Corporate Strategy: Buyer Categorization in Value Quadrant Analysis)

The organizational profile resulting from the current-state analysis, as described, encapsulates key data that will feed the planning process with richer data – broken down into three major components:

1) Operating environment & business processes

2) Business relationships

3) Key performance categories

The holistic understanding of the business ecosystem that comes from having conducted a current-state analysis allows for strategic planning to optimize the shortest path to the future-state, once it has been defined. That path is dependent upon an understanding of the business’s core values, culture, value proposition, organizational value quadrants, org structure relative to culture and external competitive environment by line-of-business (including key players like customers, suppliers, partners and channel relationships). The comparison of the organizational profile to the challenges identified during this step result in the gap that serves as the basis for planning.

CSF #2: Engage Employees Across the Organization In Strategic Planning

Strategic planning requires “real” information related to questions like:

1 What is working well?

2 What is not working so well?

3 What are our organizational vulnerabilities?

4 Where are there untapped opportunities?

To get to this information straight from the source that knows it best, employees must be engaged in the strategic planning process as early as the current-state analysis. This is where most companies make a big mistake. The executive team pulls into a shell to “meet” about the strategic plan and routinely locks out key people from the process that might well have contributed beneficial ideas and information. This is not done intentionally of course. It is done out of habit and expediency. “Let’s get the executives and their managers into planning sessions and get this done…”. Such sentiments are common and can be heard in companies around the world.

It is unfortunate, but closed loop thinking like this often hatches flawed strategies as a result of executive management groupthink. “Happy talk” takes control and the management team convinces themselves that the business is doing relatively well…oblivious to threats and issues awaiting them in the near future. The planning process requires realism to actually produce a valuable result.

Operational Realism: Businesses need the discipline of a planning process which structures an analysis of operations – allowing the organization’s employees to provide input into the planning process. This action engages employees and is especially beneficial in helping executives have a better understanding of today’s reality across the business. That dose of operational reality is essential to constructing meaningful strategy and planning realistic execution. Getting to business truth even extends beyond the organization to include engaging key suppliers, distributors, channel partners and customers in aspects of the planning process.

Cultural Realism: Business truth includes understanding not only operational issues facing the business, but also more subtle disconnects and problems not so easily detected – yet equally important. Understanding culture is understanding “Who are we as a company, really?”

Culture is defined by what members of the organization, and the organization as a whole, do to create success. Culture is about an organization’s core values and how members define acceptable and unacceptable behavior. In planning, a clear understanding of culture provides a framework for understanding the “What, Why and How” work gets completed.

Value Proposition Realism: A value proposition can be thought of as a set of market promises based on capability and credibility, that helps prospective customers understand how the companyʼs offering uniquely addresses specific problems, opportunities and challenges. Testing the internal perception of organization’s value proposition at different levels of the organization provides yet another form of business truth. It indicates where there is consistency, where there are disconnects and if value is being communicated to the marketplace effectively.

Core Competency Realism: Companies must realistically assess their core competencies because they are the underpinnings of the organization’s skills and the cornerstone of successful strategic execution. They represent the fundamental knowledge, abilities and expertise of an organization. True ability to understand and measure organizational core competencies is a critical factor in reaching strategic goals.

Industry Realism: Understanding the company’s position in the market place is essential. Now more than ever, business leaders must clearly understand the directional flow of their industry and plan for transitions and consolidations that may be occurring now or are on the horizon. Data must be gathered from managers and employees in sales, marketing, customer service, supply-chain and other areas of the business in order to gain true visibility into the organization’s industry and market sectors. This information can be used in techniques like 5-Forces to analyze threats such as: substitute products, established rivals and new entrants. Likewise, this analysis of the industry ecosystem can help in examining “vertical” pressures related to the bargaining power of suppliers and the bargaining power of customers.

The Global Factor: Approaches to strategy and planning in multinationals requires more effort due to more complex organizational structures and market specific factors global companies face. Corporate strategy must be “localized” to allow the business to respond appropriately to geographic-based opportunities and threats. Likewise, strategy development must include the involvement of the company’s foreign business leaders to help the strategy be adapted correctly to local needs. Exactly how this is done is dependent upon the type of structure the company has decided best suits the organization (e.g. matrix, product, geography, etc.).

Multinational strategies are shaped by the trade-off between opportunity and risk. Three broad environmental factors determine that trade-off. The first is the prevailing political economy, including the policies of both host and home governments, and the international legal framework. The second is the market and resources of the host country. The third factor is competition from local firms.

Given these factors, one challenge multinational companies face is recognizing the need to “localize” strategies. Once that recognition has set in, the next challenge is then determining how best to accomplish localization.

Strategy localization is needed in order to allow the business to respond appropriately to geographic-based opportunities and threats. Corporations should expect cultural heuristics to differ from country to country. Likewise, markets operate differently across the world, and there is no “one size fits all” approach to successfully conquering them. Competitor threats must be addressed with locally adapted strategies to be effective, thus the competitive analysis involved with strategic planning is a requirement to successfully navigate the terrain of the region’s business ecosystem. Marketing and sales tactics are only part of geographic differentiation, although they are certainly not insignificant in terms of importance. There are also unique supply-chain considerations to factor into local strategies. Resource costs, including labor, vary widely across countries. It doesn’t stop there. Legal systems, labor laws and distribution systems also impact local strategy. For this reason, operational considerations related to pricing, production and distribution also cannot be ignored with a cookie cutter corporate strategy that is imposed across countries / geographies.

None of this means that the foreign-based division can go rogue and operate business practices that run counter to the strategic goals of the parent. What it does indicate, however, is that parent company’s corporate strategy must be operationalized to fit localities.

The People Factor: Implementing corporate strategy is dependent upon the energy, dedication, hard work and faith of the organization’s employees. Motivating employees to act decisively in the face of uncertainty is a challenge where many an organization have failed miserably. Simply stated, a considerable amount of energy is required to drive strategies to fruition – and that energy must be generated from within the organization. The more that employees have been involved in the process of creating the strategy, the more they will have already bought into it – helping fuel strategy delivery and thus propelling the momentum of execution to make it both easier and smoother. When it is not possible to broadly involve employees in some way, the communication effort surrounding the strategy needs to be amped up across the organization to compensate for the fact that many if not most employees will be in the dark regarding the strategy and what is expected of them.

The Next Segments

In the upcoming segments of the article series, six more of the eight critical success factors will be introduced and discussed.

***

Resources for Taking Action

Free Strategic Planning Article Compilations and PDFs:

1 Free access to the Strategic Planning Monthly: Archive

2 Free Online Strategic Planning Articles Library

3 Free Strategic Planning PDF Downloads

4 Information about Strategic Planning Learning and Development Programs

Category: Communication & Alignment

Tags: Analysis, Execution, Planning, profitability, Strategy, Success

This is a great article Joe! It’s very well explained about the strategic process – not only the “pit falls” to avoid but even more importantly, the factors to consider prior/due to execution. Great material for discussions in executives teams! Looking forward to the following articles in the serie. /Ulrika