WSJ/Vistage Apr. 2020: Small business confidence plunges during economic shutdown

Highlights:

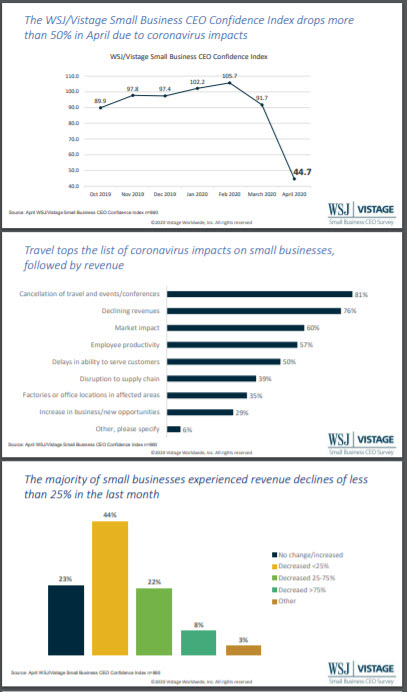

- The WSJ/Vistage Small Business CEO Confidence Index dropped more than 50% to a record low of 44.7 in April

- 33% of small business CEOs believe the economy will improve in the year ahead, up from 19% last month

- Cost containment is critical in the coming year; 52% of CEOs report they will decrease fixed investments

Confidence among small business CEOs plunged to a record low in April due to the impacts of the coronavirus and the consequent shutdown of the national economy, according to the most recent survey conducted by Vistage in partnership with the Wall Street Journal.

The WSJ/Vistage Small Business CEO Confidence Index fell to just 44.7 in April, down more than 50% from the 91.7 recorded in March.

This unprecedented decline will likely be mirrored in the Q2 GDP. While a recession is defined as two quarters of consecutive decline in GDP, many economists believe the trends are already showing that we will experience those declines, officially putting the U.S. in a coronavirus-induced recession. As Vistage Chief Research Officer Joe Galvin has stated, “The length of the health crisis will determine the depth of the financial crisis.”

WSJ/Vistage Small Business CEO Confidence Index

October 2019 – April 2020

Dr. Richard Curtin, a researcher at the University of Michigan who analyzed the data, said that in the recovery phase, businesses will take a variety of precautionary measures.

“This will likely include fewer investments and slowed hiring,” says Dr. Curtin. “Small businesses will focus on bolstering retained earnings to achieve greater financial security.”

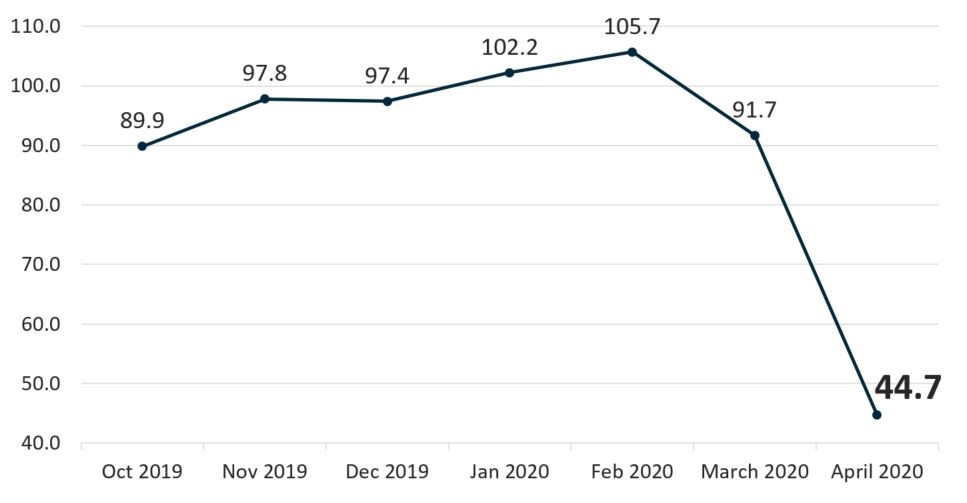

The April data shows that 52% of small business CEOs are planning cutbacks to fixed investments, an almost a complete reversal from February when 44% of CEOs indicated plans to increase investments. According to Dr. Curtin, “While such sizable cutbacks reflect significant declines in current sales revenues, those declines also represent losses in future productivity and will lower CEOs’ capability to expand future production.”

Dichotomy of expectations

Based on the stand still of the economy, it is possible that small businesses may not expect any more sharp declines in the economy. One-third (33%) of CEOs expect economic improvements in the year ahead — an improvement from the 19% recorded in March.

However, that same data shows that 57% expect the economy to worsen, up 16 points from 41% in March. This reveals that small business CEO sentiment is divided, likely based on the impact on their businesses. It is important to note that 23% of CEOs reported stable to increased revenues, and their optimism around business growth may create this dichotomy.

That said, Dr. Curtin notes that it is “unreasonable to anticipate that the economic revival will proceed quickly across all small businesses. It is more likely to be a gradual reopening across regions and industries, and an even slower revival in the willingness to spend among the customers of these small businesses.”

Bright spots break through the dark cloud of the economic slowdown

While we wait to see what the re-opening of the country will look like, there are some bright spots.

In addition to the 23% of CEOs who have maintained revenue (18%) or experienced growth (5%), there are a number of businesses experimenting with new products and services. Thirty-nine percent of CEOs reported that they have made changes in the products and services they offer as a result of the pandemic.

One example includes Vistage member company Bednark Studios, a full service fabrication company that has partnered with the neighboring Brooklyn Navy Yard to build face shields for medical workers. Not only are they filling a need, but they have been able to employ many people who lost work due to the coronavirus economic shutdown.

The April WSJ/Vistage Small Business CEO survey was conducted April 1 – 8, 2020 and gathered 860 responses from CEOs and other leaders of small businesses. Our May survey, in the field May 4 – 11, will reveal if small businesses remain at the bottom waiting for signs of relief, or if more bright spots are breaking through, indicating the signs of recovery for small businesses.

Download the April report for the complete analysis

Related links

Category: Economic / Future Trends

Tags: Challenging Times Business Strategies, coronavirus, Small business, US Economy, WSJ Vistage Small Business CEO Survey