WSJ/Vistage Mar. 2020: Small business confidence drops amid coronavirus concerns

Highlights:

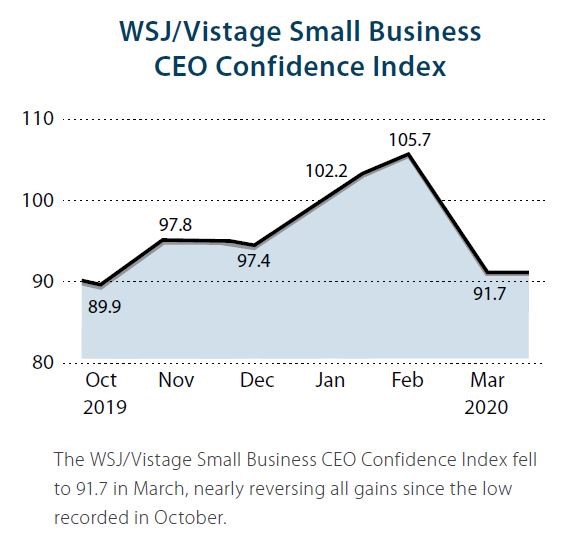

- The WSJ/Vistage Small Business CEO Confidence Index reversed all gains from the last 4 months, falling to 91.7

- Twice as many small business CEOs believe the economy will worsen (41%) than improve (19%)

- 38% of small businesses were moderately or extremely concerned about coronavirus at the time of the survey

Early news on coronavirus impacts plans of small business CEOs

Confidence among small businesses fell significantly in early March, reversing the gains recorded in the prior four months, according to the most recent survey conducted by Vistage in partnership with the Wall Street Journal.

This decrease in confidence was largely due to two unforeseen black swan events: The coronavirus outbreak and related impacts ramped up during the course of the survey, along with the fall of oil prices.

Because the survey was conducted March 2 – 9 as news headlines were emerging, the full impact of these events is not reflected in the data.

According to Dr. Curtin, a researcher from University of Michigan who analyzed the data, “These issues and levels of concern mainly reflect concerns when China was the epicenter of COVID-19. These concerns can be expected to shift and to intensify along with the spread of the virus that has occurred since the survey and in months ahead.”

The WSJ/Vistage Small Business Index fell to 91.7 in March, slightly above last October’s low of 89.9, which had declined due to uncertainties about the impact of Trump’s evolving trade policies.

Curtin reflects over historical data, noting that “the last time we saw the Index fall to numbers this low was in November 2012, when it fell to 83.9 due to uncertainties about falling off the ‘fiscal cliff.’”

While all factors that comprise the Small Business Index fell, what drove the decline in the Index was sentiment about the U.S. economy in the next 12 months. Twice as many small business CEOs believe that the economy will worsen rather than improve during the year ahead – 41% versus 19%.

Based on that sentiment, CEOs are adjusting their investment plans accordingly. While just 15% of CEOs plan to cut fixed investments, this is the highest percentage in four years. And just 7% of CEOs reported plans to reduce their workforces.

Curtin speculates that “postponed investments are much less costly to firms than reducing their trained workforces, especially when the business disruption is expected to be temporary and interest rates are anticipated to remain low well after the health crisis is over.”

As we wait to find the peak of the health crisis and the bottom of the financial cycle, Vistage Chief Research Officer Joe Galvin says that “the length of the health crisis will determine the depth of the financial crisis.”

The March WSJ/Vistage Small Business CEO survey was conducted March 2 – 9, 2020 and gathered 915 responses from CEOs and other leaders of small businesses.

Download the March report for the complete analysis

Related links

Interactive data

About the WSJ/Vistage Small Business CEO Survey

Category: Economic / Future Trends

Tags: coronavirus, Small business, US Economy, WSJ Vistage Small Business CEO Survey