Economic optimism edges up among small businesses, in Sept. WSJ/Vistage Survey

Small businesses are beginning to feel more optimistic about the economy, according to the September Wall Street Journal/Vistage Small Business CEO Survey. The uptick in confidence is a departure from the small losses recorded in the prior two months.

Small businesses are beginning to feel more optimistic about the economy, according to the September Wall Street Journal/Vistage Small Business CEO Survey. The uptick in confidence is a departure from the small losses recorded in the prior two months.

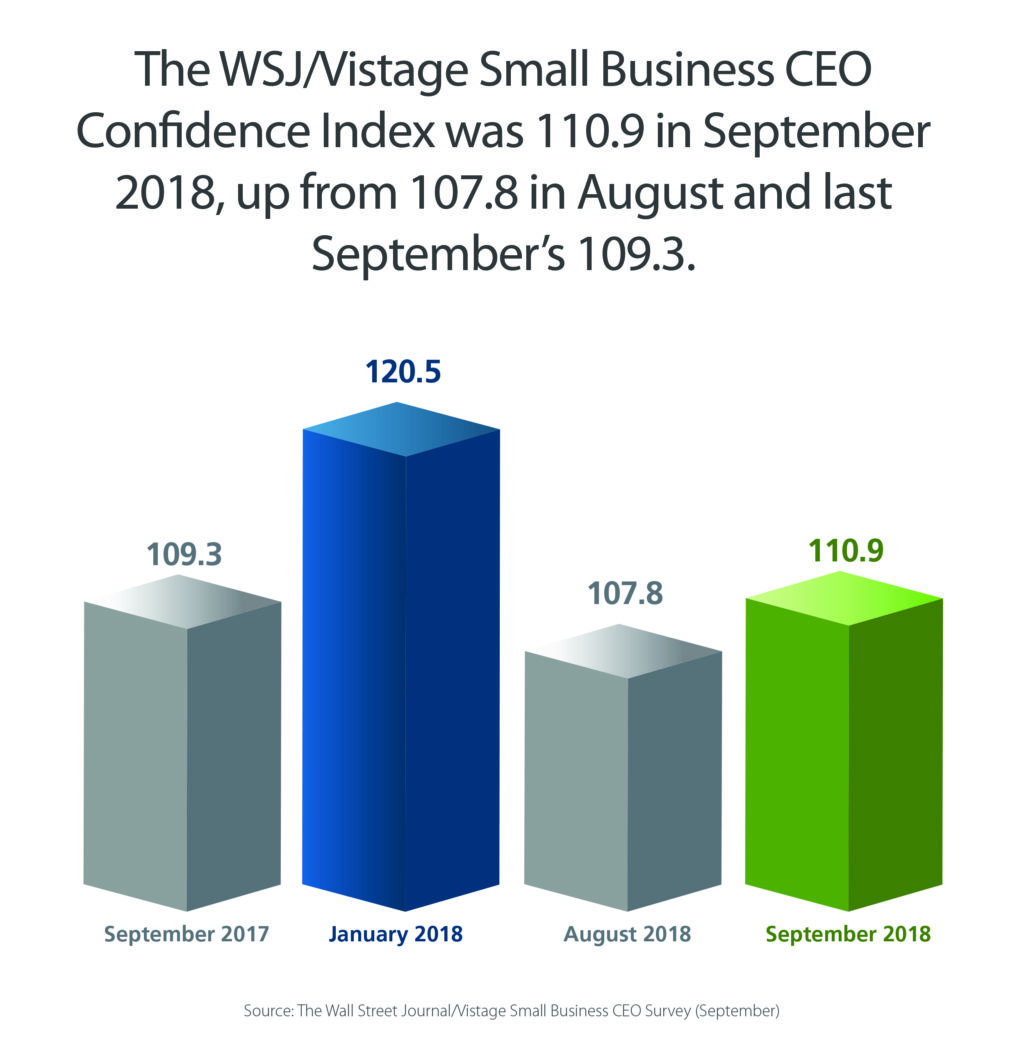

While confidence remains below the peaks recorded at the start of the year, which were due to new tax policies, it has remained at elevated levels since President Trump took office. The WSJ/Vistage Small Business CEO Confidence Index was 110.9 in September 2018, up from 107.8 in August and last September’s 109.3.

Nearly all of the Index components rose in September over August. However CEO assessment of future prospects for the U.S. economy sustained a decline. Importantly, expectations for revenue and profit growth remained as favorable, prompting firms to increase fixed investments and expand their workforce in the year ahead.

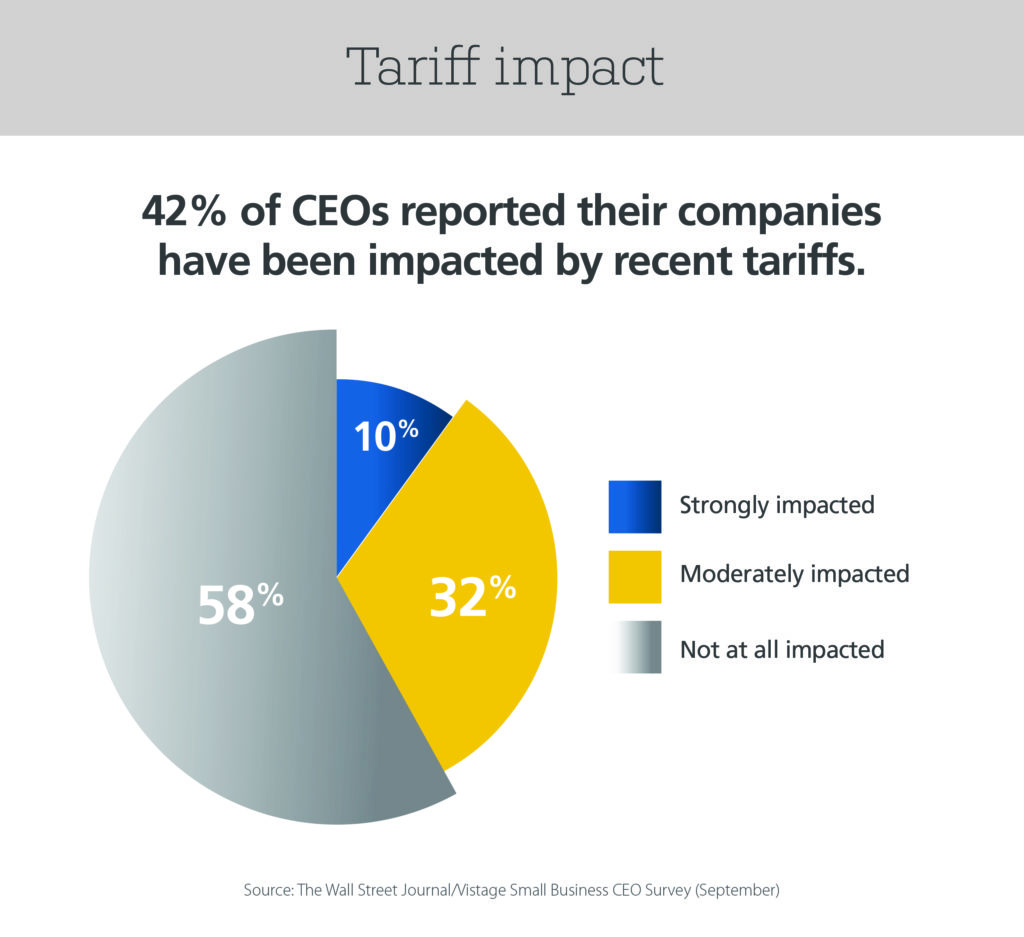

When asked about the impact of Trump administration policies on prospects for their own business: 42% reported improved prospects, only slightly below the January peak of 52%. This high level of support came despite rising concerns about the impact of tariffs on their cost of materials.

When asked about the impact of Trump administration policies on prospects for their own business: 42% reported improved prospects, only slightly below the January peak of 52%. This high level of support came despite rising concerns about the impact of tariffs on their cost of materials.

- Only 10% of firms reported that they would be strongly impacted.

- Another 32% expected to be moderately affected.

- While 57% expected no direct impact on their firm.

The only tool to mitigate increases in inflationary trends, aside from new trade agreements, is higher interest rates. A quick settlement with China, however, looks unlikely at present.

Strong prospects for revenues and profits.

Strong prospects for revenues and profits.

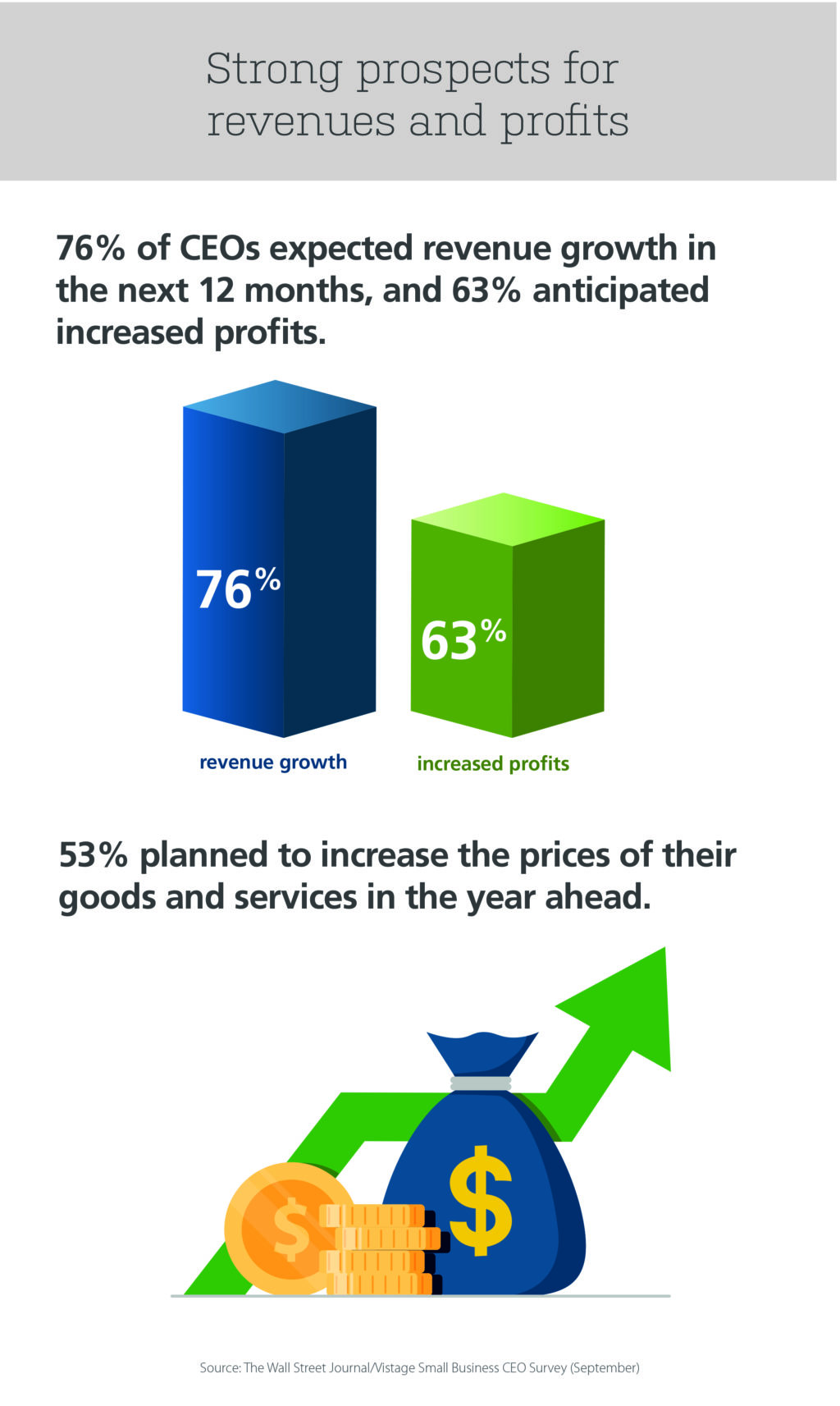

Expectations for both sales revenues and profits for the year ahead improved from a month ago and neared last September’s levels.

- 76% of CEOs expected revenue growth in the next 12 months, up from 73% one month ago.

- 63% of CEOs anticipated profit increases in September, just ahead of the 61% recorded in last month’s survey.

- 53% of all small firms in the September survey planned to increase the prices of their goods and services. That suggests most firms anticipate they will be able to pass cost increases to their customers, leaving profit margins unchanged.

Continued strength in expansion plans.

Continued strength in expansion plans.

Despite the expectation of a slowing pace of economic growth in the year ahead, small firms remained quite bullish on plans for investments in new plant and equipment as well as increases in their workforce.

- 50% of all CEOs reported plans to increase fixed investments in the September survey, slightly above the 46% recorded both one month.

- 65% of firms reported plans for workforce expansion in the next 12 months, just ahead of the 64% recorded both one month and one year earlier.

Expansion of investments and employment are now at quite favorable levels. This strength in their willingness to expand their firms is perhaps the best “bottom-line” indicator of their confidence that the expansion will continue even if at a slower pace of growth.

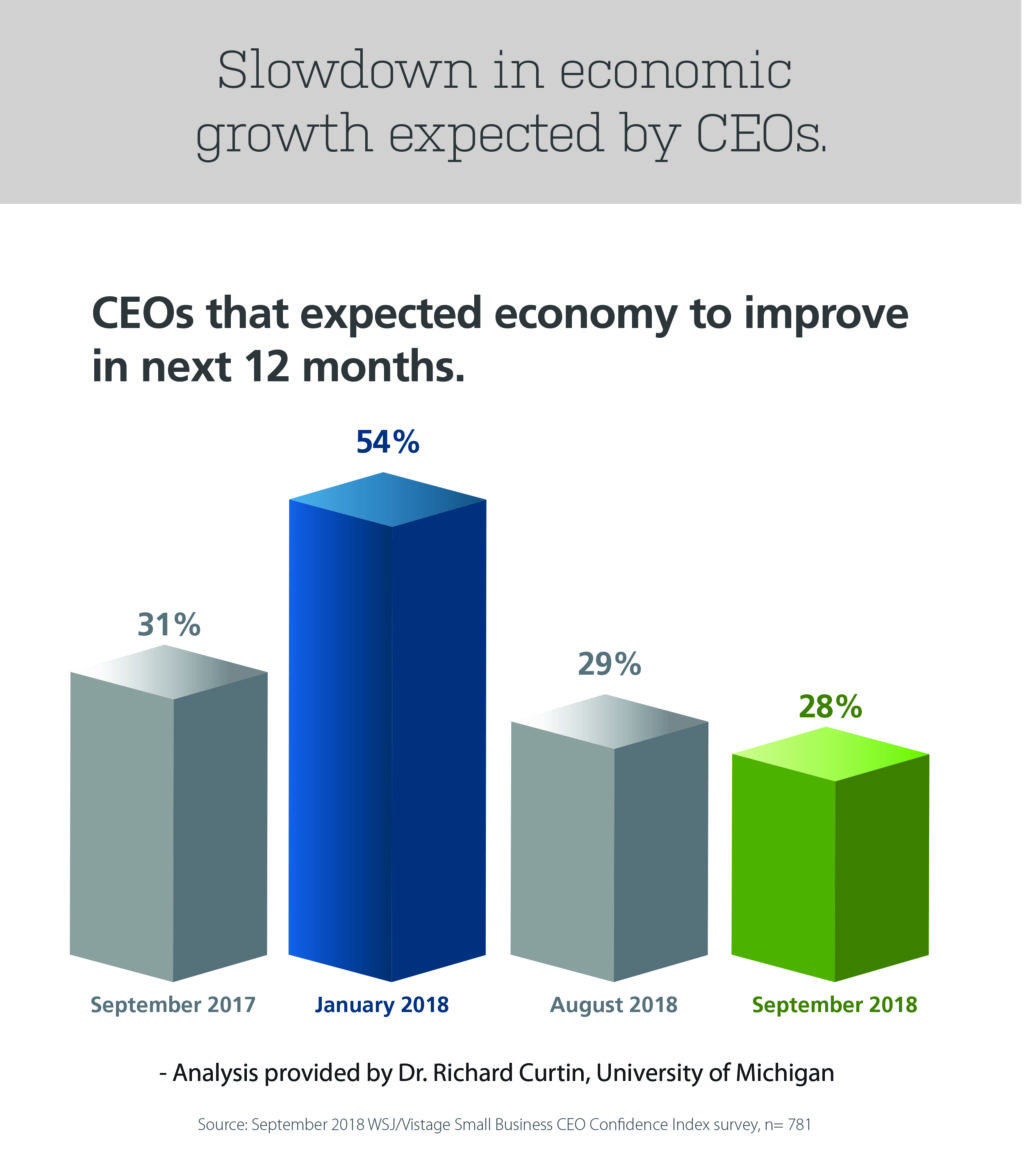

Slowdown in economic growth expected.

The positive recent GDP report was reflected in how firms judged current economic conditions, but it did not have much impact on how they evaluated future economic prospects.

- 28% of CEO said the economy would improve in the next year, up from last month’s 29% but well below the January 2018 peak of 54%, mainly due to the initial enthusiasm around tax cuts.

- 62% of CEOs said the economy had improved in the past year, just above last month’s 60% and well above last year’s 50%.

Related articles:

Wall Street Journal / Vistage Small Business Monthly CEO Survey

Feeling the squeeze of cost pressures? These 4 fixes can help

Category: Economic / Future Trends

Tags: CEO confidence survey, tariffs, WSJ Vistage Small Business CEO Survey