CEO confidence steadies in April WSJ/Vistage survey

After recording two consecutive months of declining optimism among small-business CEOs, the Wall Street Journal/Vistage Small Business CEO Survey saw a slight uptick in CEO confidence this month.

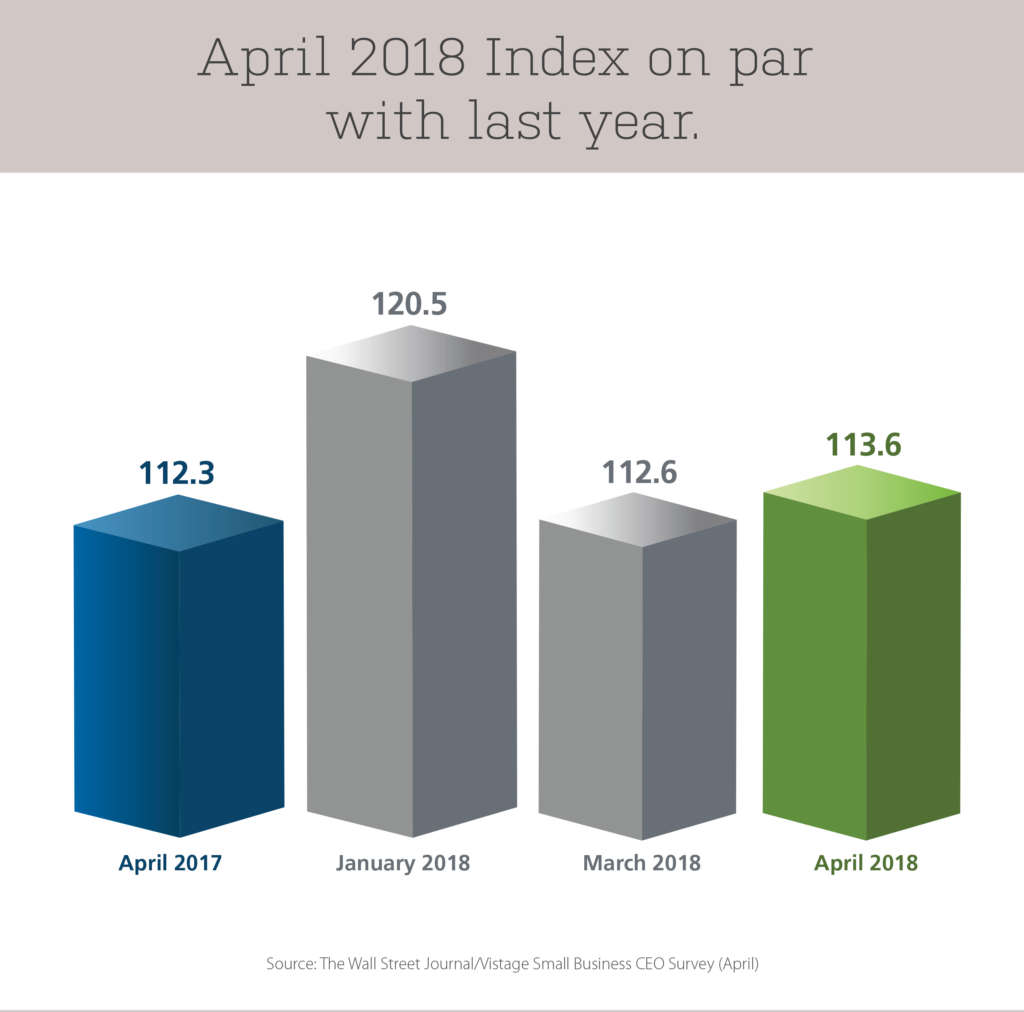

The April 2018 survey, which had 1,022 respondents, recorded a CEO Confidence Index of 113.6. By comparison, the index was 112.6 last month and 112.3 one year ago.

“While the current level of confidence is below [the survey’s] six-year peak of 120.5, which was sparked by the passage of the tax reform legislation, confidence remained near the top of the range since the survey began in mid-2012,” said Dr. Richard Curtin, an analyst from the University of Michigan who reviewed the survey results.

Other highlights from the survey include the following.

International trade policies raise concerns

International trade policies raise concerns

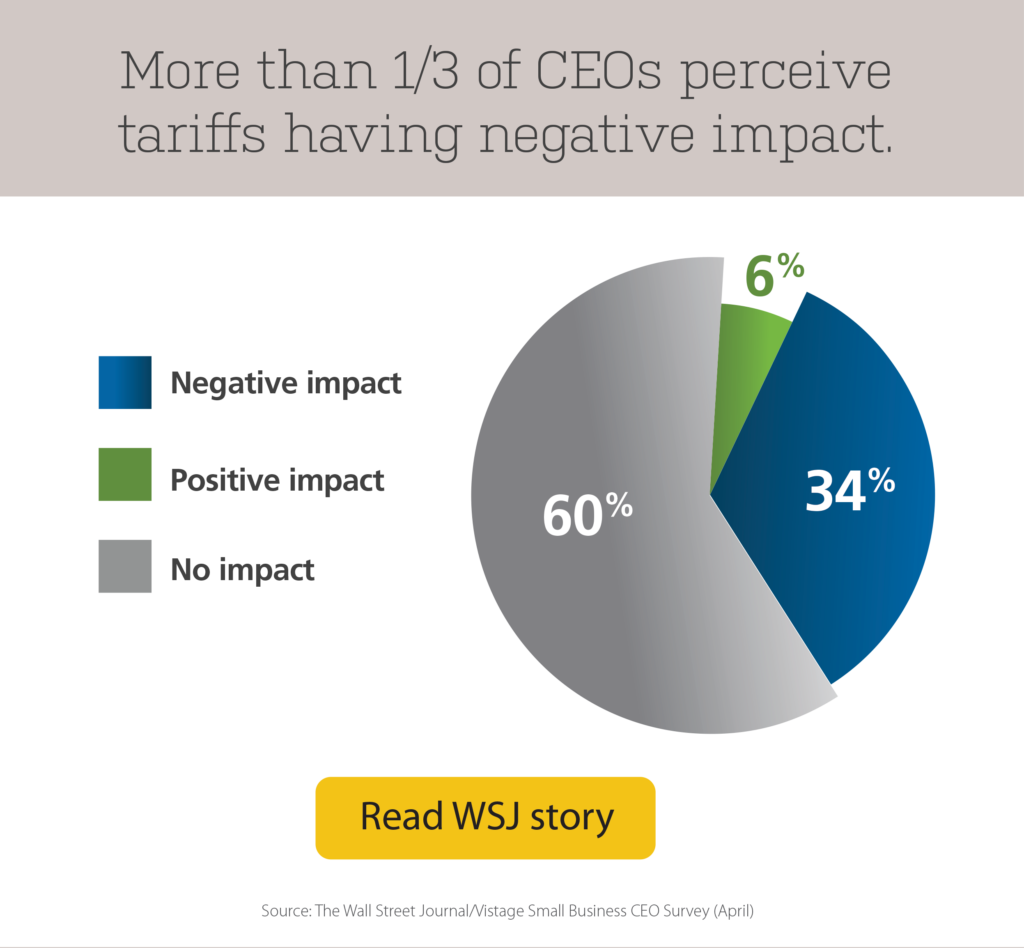

Many small-business CEOs believe that new U.S. tariffs will have a detrimental effect on their companies.

More than one-third (34%) of CEOs said that the tariffs would have a negative impact on their business, while only 5% said that they would have a positive impact. However, 60% of CEOs said that the tariffs would not impact their business.

“While the survey clearly found the new tariffs are perceived to be harmful to small business, the extent of the potential harm — judging from its impact on profits and revenues — was still quite small,” said Curtin.

Profit expectations reach record highs

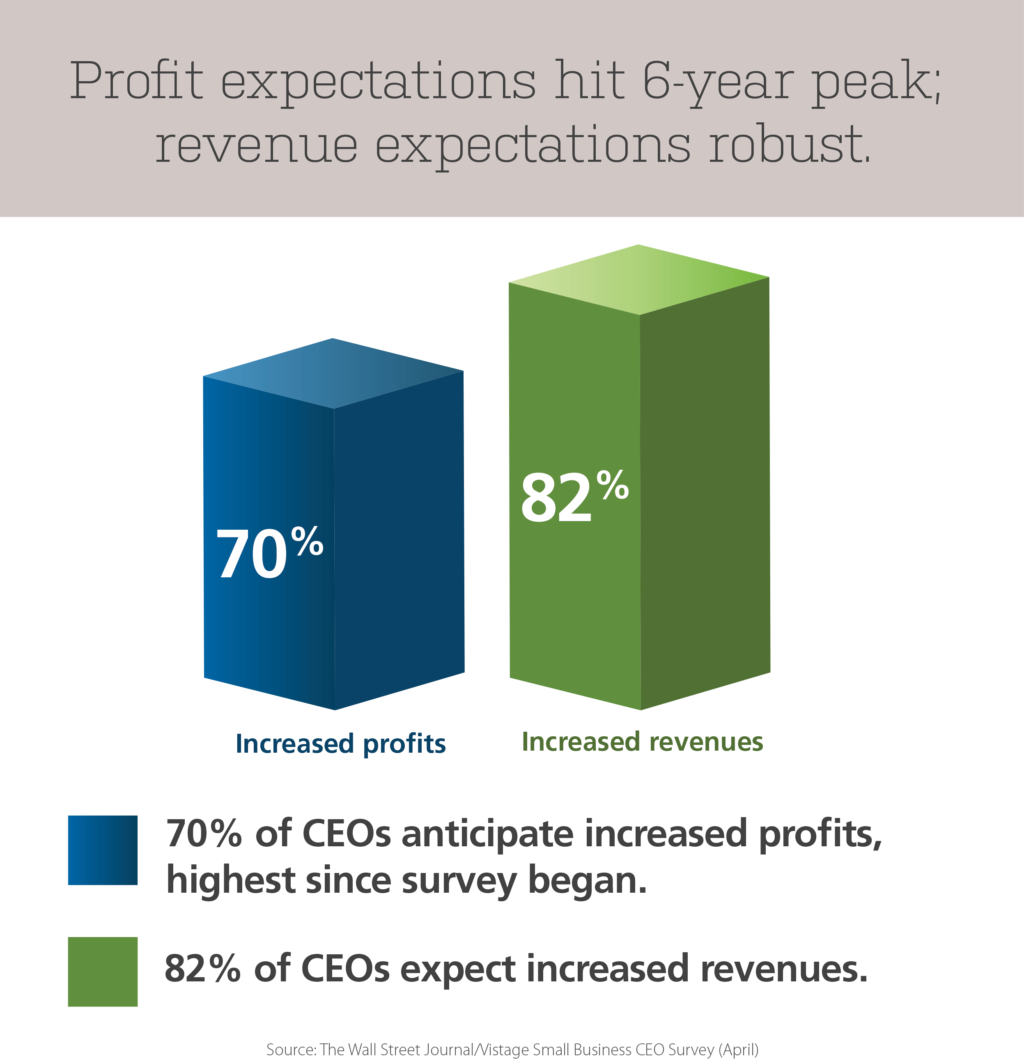

CEOs expressed very strong financial prospects for their small businesses in April. Nearly three-quarters (70%) of CEOs noted that they expected their firms’ profits to increase in the next 12 months, which is the highest proportion recorded by the survey since it began in 2012. Only 4% of CEOs expected that their firms’ profits would decrease, which is the lowest percentage recorded by the survey.

Similarly, the majority of CEOs (82%) expected their revenues to increase in the year ahead. This ratio is close to the record peak of 83% recorded earlier this year.

“Presumably, this favorable evaluation was due to the tax reforms as well as increasing sales revenues,” said Curtin.

Small firms continue with expansion plans

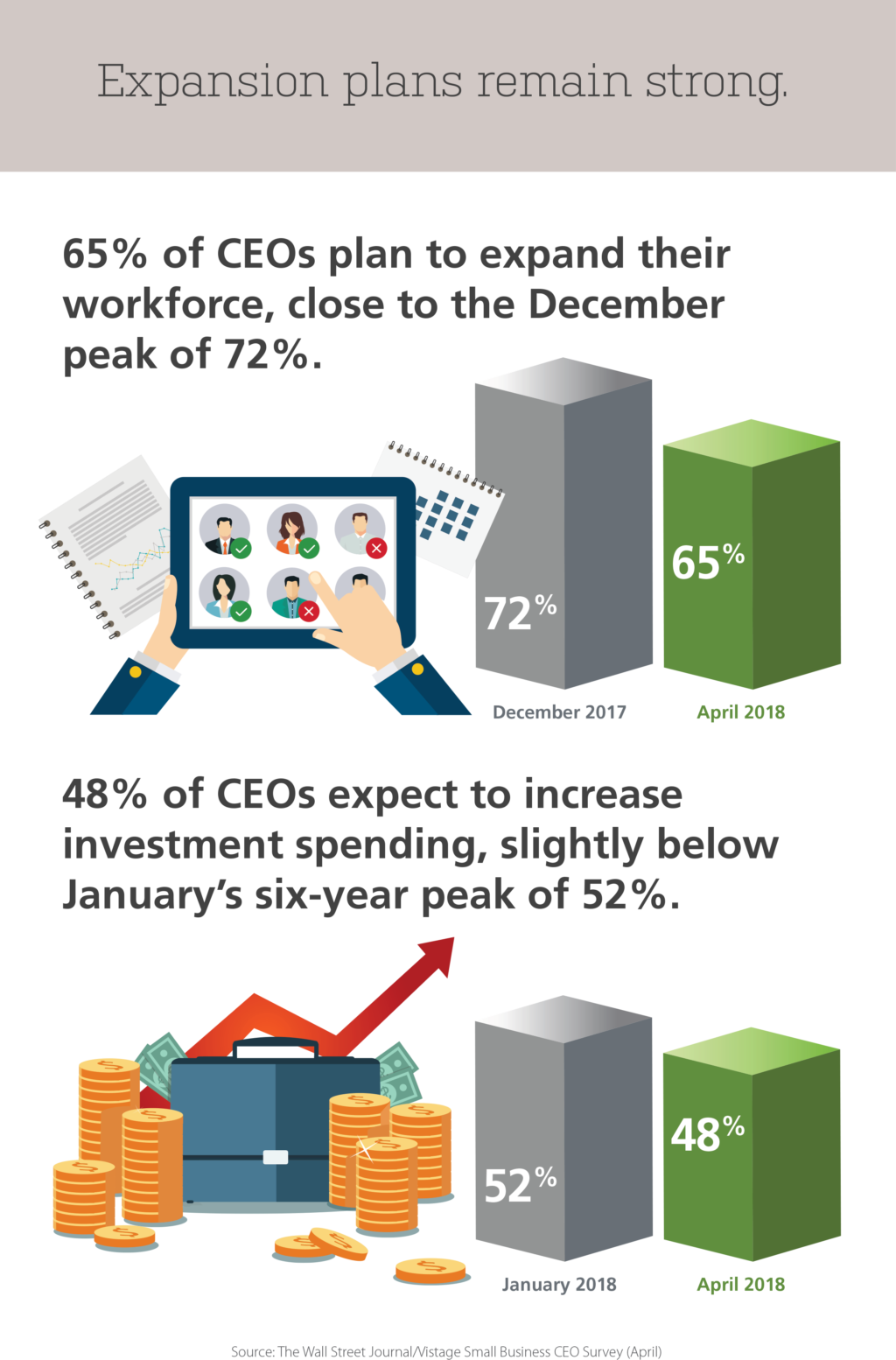

Nearly two-thirds (65%) of small-business CEOs say they plan to increase their workforce in the next 12 months. By comparison, this was reported by 72% of CEOs four months ago (a record peak) and 61% of CEOs one year ago.

In addition, 31% of CEOs plan to maintain the size of their workforce in the year ahead. Only 3% plan to decrease their workforce.

A tight labor market continues to motivate companies to focus on retaining employees, especially those who are nearing retirement age. Six out of 10 firms have made accommodations for their aging workforce, whether by offering more flexible hours (42%), shifting employees to new roles (35%) or providing retraining programs (13%).

Nearly half (48%) of small-business CEOs said they plan to expand their investments in new plant and equipment in the next year. This is just below the 52% peak recorded at the start of 2018.

However, 46% of CEOs said that their investment expenditures would remain unchanged in the year ahead.

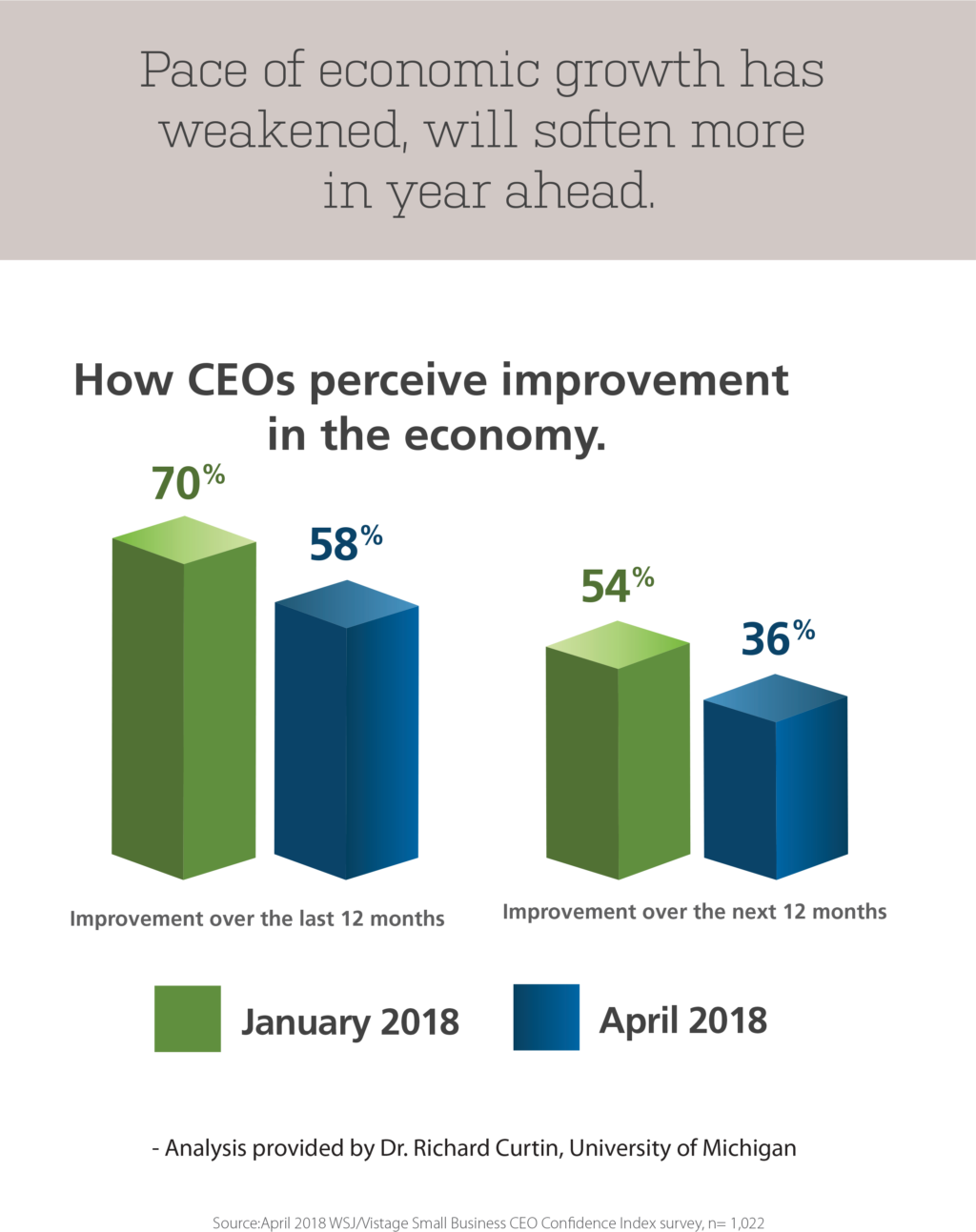

CEOs less optimistic about U.S. economy

In contrast to the prospects of their own firms, CEOs are apprehensive about the future growth of the U.S. economy. Only 58% of CEOs cited recent economic gains, compared to 70% three months prior. About one-third (36%) of CEOs said that they expected economic gains in the year ahead, compared to 54% three months ago.

“Presumably, some of the decline was due to the expectation of repeated interest rate hikes in the year ahead, as well as the temporary weakness in the economy during the 1st quarter of 2008,” said Curtin. “The economic outlook should bounce back in the months ahead.”

Category: Economic / Future Trends

Tags: Economy, Hiring, WSJ Vistage Small Business CEO Survey