The benefits of partial ESOPs

Authored by Nick Francia and Keith Apton

What is an ESOP?

An Employee Stock Ownership Plan (or “ESOP”) is a flexible, tax-efficient exit strategy for owners of privately held businesses.

What are the benefits of an ESOP?

An ESOP allows a business owner to sell a portion or all of their stock in the company and defer or, with the proper planning, permanently avoid paying the capital gains taxes otherwise payable in connection with the sale. At the same time, it can act as a way to reward employees with an additional retirement benefit. An ESOP can provide a solution to one of the most difficult challenges faced by all kinds of businesses: aligning the goals and incentives of the employees with those of the company and its management.1

|

Don’t miss our May 7 webinar! |

How can ESOPs help business owners?

ESOPs are flexible in the fact that a business owner can sell any portion of their stock to the ESOP, from 1% to 100%. If the owner chooses to sell less than 100% of their stock, they always have the option to sell more stock to the ESOP in the future.

ESOPs also offer flexibility for privately held companies with multiple owners. For example, if a company has three owners and one wishes to retire, an ESOP allows that owner to sell his or her stock and exit the company, while the other two stay on and have the opportunity to remain active in the business.

Selling a minority stake of a business to an ESOP offers the owners the unique ability to solve multiple problems with one solution. It can act as a tool for selling shareholders to extract liquidity from the company while still allowing the owners to retain controlling interest.

ESOPs for S and C corporations

Selling shares to an ESOP can provide tax advantages for both the company and the selling shareholder if the transaction is structured properly. If the company is structured as an S corporation following the sale, it will operate as a federal income tax–exempt entity to the extent of ESOP ownership, and will often be tax-exempt at the state income level as well. For example, if an ESOP owns 49% of company stock, then 49% of the company’s profits will not be taxed.2

Alternatively, if the company is a C corporation at the time of the sale, the selling shareholder can defer or potentially eliminate capital gains taxes on their proceeds from the stock sale by electing Section 1042 of the Internal Revenue Code and ensuring that several legal requirements are met during the sale process.

Some business owners will elect C-corporation status prior to selling stock in order to elect Code Section 1042. Upon making this election, there is a mandatory waiting period of five tax periods before the company can revert back to S corporation status and enjoy the tax advantages referred to above.3

ESOPs under the Biden administration

President Biden has proposed a tax plan that could potentially double the long-term capital gains tax rate for wealthy individuals.4 Under Code Section 1042, an owner selling stock in their privately-held company could defer or potentially eliminate capital gains taxes with respect to the sale. This option looks increasingly attractive in the face of much higher capital gains tax rates.

President Biden’s proposed tax plan would also increase corporate federal income tax rates.5 100% ESOP-owned S corporations are exempt from federal income taxes, which would protect the company from the impact of such a tax increase.

How can ESOPs help employees?

In addition to providing liquidity and diversification for owners, an ESOP gives employees an ownership stake in the company through contributions of its stock; thus, employees directly reap the benefits of their business’s good performance through increased stock prices, and they will also feel the pressure if performance is lacking and prices fall.

The ESOP provides a qualified retirement plan for each employee. This is in addition to any other traditional retirement plans that the company has in place, such as a 401(k). Contributions of shares to employees are deposited into individual ESOP accounts. Employees do not pay for the shares in any manner, nor do they pay taxes on the shares or any interest income earned in the ESOP account until they begin receiving distributions, just like any other qualified retirement plan. Distributions can also be rolled to another qualified retirement plan and/or into the employee’s IRA to continue deferring taxation.6 Improvements in company performance can lead to increased share prices, which, under an ESOP, directly benefits the employees’ ESOP accounts; this positive feedback cycle creates an atmosphere that rewards highly motivated employees.7 There is a statistically significant relationship between ESOPs and company performance which suggests that ESOP-owned companies outperform businesses that do not have ESOPs.8

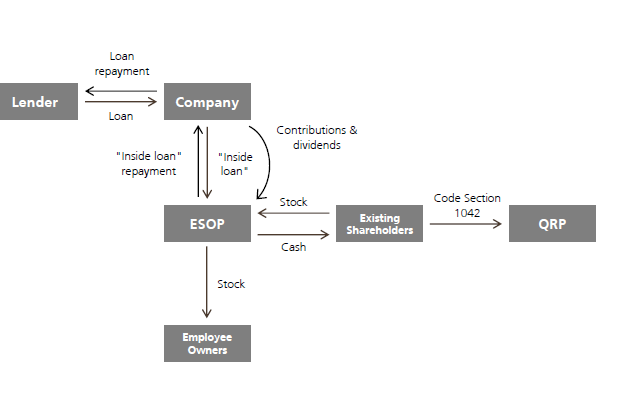

One of the most common misconceptions is that the employees must purchase the stock. In reality, the money comes from the sponsor company who borrows the funds from a commercial lender. Please see the diagram below for the flow of funds of a leveraged ESOP transaction.

ESOP considerations

The establishment of an ESOP, when done correctly, has the potential to lead to a variety of improvements in multiple aspects of a company, from profitability to corporate culture. When managed properly, the benefits can extend to both the employees and the company itself, ultimately helping to create an environment that both facilitates and rewards high levels of employee motivation. A partial sale to an ESOP may be useful in addressing multiple issues faced by business owners who are looking to sell. In the short term, it can help satisfy the need or desire for liquidity and diversify a shareholder’s wealth away from the business. It can also provide long-term flexibility for the owners.

An ESOP may not be the best option for all businesses and there are expenses and other considerations in implementing an ESOP and participating in a sale to an ESOP but the solution should be evaluated by business owners contemplating a sale. Business owners should seek the advice of people experienced in these types of transactions before participating in one.

Cash flow of a leveraged ESOP transaction:

- Company creates ESOP

- Company borrows funds from Lender

- Company lends the proceeds to the ESOP through an “inside loan”

- ESOP uses proceeds to purchase shares from existing shareholders

- Existing shareholders have the option to elect Code Section 1042 treatment and purchase QRP

- Company makes tax-deductible contributions to the ESOP

- ESOP repays the “inside loan” to the Company using the contributions and dividends

- Company repays the Lender

- Shares held by the ESOP are released to employee accounts as the “inside loan” is repaid

Based in Washington, DC, Keith Apton and Nick Francia of The Capital ESOP Group are nationally recognized speakers on the topic of ESOPs.* The Capital ESOP Group is a financial advisory team within UBS, one of the world’s largest global wealth managers. The Capital ESOP Group has helped create over $2.5 billion of liquidity through successful transactions and is ideally positioned to help business owners and their trusted advisors understand if an ESOP is the right fit for their company.

References

1https://www.esop.org/

2“How an employee stock ownership plan (ESOP) Works.” NCEO, 10 April 2018, www.nceo.org/articles/esop-employee-stock-ownership-plan.

3“26 CFR §1.1362-5 – Election after termination.” Legal Information Institute, Cornell Law School, www.law.cornell.edu/cfr/text/26/1.1362-5.

4https://www.natlawreview.com/article/tax-proposals-president-elect-biden-and-other-prominent-democrats

5https://www.cnbc.com/2021/01/25/eys-carmine-di-sibio-the-danger-for-business-under-biden-is-taxes.html

6mercercapital.com/article/esops-the-basics-and-the-benefits.

7amanet.org/articles/how-employee-ownership-benefits-executives-companies-and-employees.

8nceo.org/article/academic-research-employee-ownership

* Keith is an approved teacher on ESOPs for the Exit Planning Institute. Keith and Nick sit on the finance committee for The ESOP Association. Keith and Nick consistently speak at The ESOP Association and NCEO national and local conferences. Keith and Nick are approved speakers for the National Association of State Boards of Accountancy. Keith is an approved speaker for Vistage. Nick has spoken to the American Bar Association ESOP subcommittee.

Neither UBS Financial Services Inc. nor any of its employees provide tax or legal advice. You should consult with your personal tax or legal advisor regarding your personal circumstances.

Information contained herein is of a general nature and is provided for informational purposes only. Laws governing ESOP transactions and the rules under Section 1042 of the Internal Revenue Code of 1986, as amended (“Code”), are complex and persons considering an ESOP or Section 1042 transaction should seek professional guidance from their tax and legal advisors. Specific structures and decisions can only be developed based on a thorough review of the facts and circumstances relative to a particular company and its shareholders. Neither UBS Financial Services Inc. nor its employees provide tax or legal advice.

In addition, shareholders to sell into an ESOP should understand the applicable rules of the Internal Revenue Code of 1986, as amended (“Code”), including requirements for qualified replacement property as defined by Code section 1042 (“QRP”). Shareholders should understand the potential risks that may be associated with obtaining securities as QRP, sufficiency of available QRP in the market that satisfy the shareholder’s investment objectives, limitations on UBS’ ability to offer margin or financing for the purchase of a new- issue QRP where UBS has participated in the underwriting of such new issue, availability of QRP with put features and whether available QRP offers appropriate diversification. The foregoing is a general description of potential risks. Shareholders who invest in QRP should consult with their tax and legal advisors regarding their personal circumstances.

IRS Circular 230 Disclosure: To ensure compliance with requirements imposed by the IRS, any U.S. federal tax information in this article is not intended, or written to be used, for the purpose of (1) avoiding penalties under the Internal Revenue Code, or (2) promoting, marketing, or recommending to another party any transaction or matter contained in this presentation.

As a firm providing wealth management services to clients, UBS Financial Services Inc. offers investment advisory services in its capacity as an SEC-registered investment adviser and brokerage services in its capacity as an SEC-registered broker-dealer. Investment advisory services and brokerage services are separate and distinct, differ in material ways and are governed by different laws and separate arrangements. It is important that clients understand the ways in which we conduct business, that they carefully read the agreements and disclosures that we provide to them about the products or services we offer. For more information, please review the PDF document at ubs.com/relationshipsummary.

© UBS 2021. All rights reserved. The key symbol and UBS are among the registered and unregistered trademarks of UBS. UBS Financial Services Inc. is a subsidiary of UBS AG. Member FINRA/SIPC. CJ-UBS-370913597 Exp.: 04/30/2022 Review Code: IS2102127

Category: Business Growth & Strategy

Tags: ESOP, exit strategy, UBS, Upcoming Webinar