The talent wars are a zero-sum game

Hiring challenges are dominating the thoughts of small and midsize business CEOs. As reported in CEO Projections 2022: Embrace the Employee Revolution, the Q4 2021 Vistage survey of 1,540 CEOs finds “hiring, recruitment and sourcing” is the top decision factor, biggest investment area and most significant leadership challenge for CEOs in 2022.

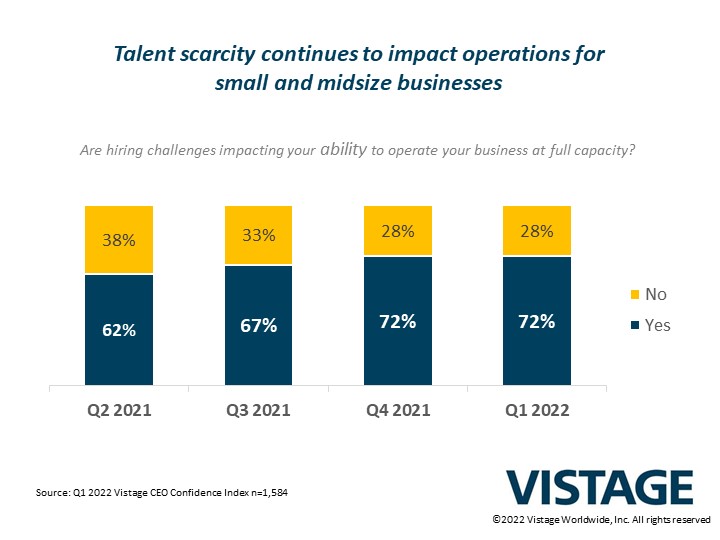

While CEOs are also concerned with surging inflation, struggling supply chains, changing customer behaviors and transition challenges, 72% say hiring challenges are impacting their ability to operate at full capacity.

People quit

Contrast today’s hiring environment with the Great Recession of 2008-09, when a broken economy led to massive layoffs and limited prospects for employment.

At the time, many workers who kept their jobs were grateful and happy to stay. After all, people don’t quit without somewhere to go. While some workers exit the workforce entirely, the majority leave one job for another.

The quits rate plummeted from 2.1% in February 2008 to 1.2% in August 2009 as the recession chewed away at jobs. It took six years for that rate to fully rebound, overlapping with a 10-year period (2010-2020) of slow, steady growth, low inflation, historically low-interest rates and the proverbial rising tide that lifted all boats.

This marked the beginning of the talent wars. To capitalize on a growing economy, more employers started hiring, which led to more competition for talent, more opportunities for workers and a shift in power from employers to employees.

It also drove a focus on employee retention. CEOs quickly recognized the talent wars were a zero-sum game, with every new employee coming from a previous employer and every lost employee going on to a better job.

In 2020, COVID-19 caused a temporary truce in the talent wars when the economy was shut down. The quits rate immediately dropped since — once again — people don’t leave good jobs without somewhere to go.

However, when the economy reopened, a surge in quit rates was triggered by a unique set of factors: namely, a rapid economic recovery, pent-up demand for change and workers’ reassessment of their work-life alignment. Working from home became standard practice for knowledge workers who didn’t want to commute back to the Monday-Friday, 9-5 (MF95) workplace.

It took just one year for the quits rate to recover, and then it accelerated again. By February 2022, it reached 2.9% (4.4 million quits), just off the all-time high of 3.0% (4.5 million quits) recorded in November 2021. This surge took the talent wars to a new level.

Retention first

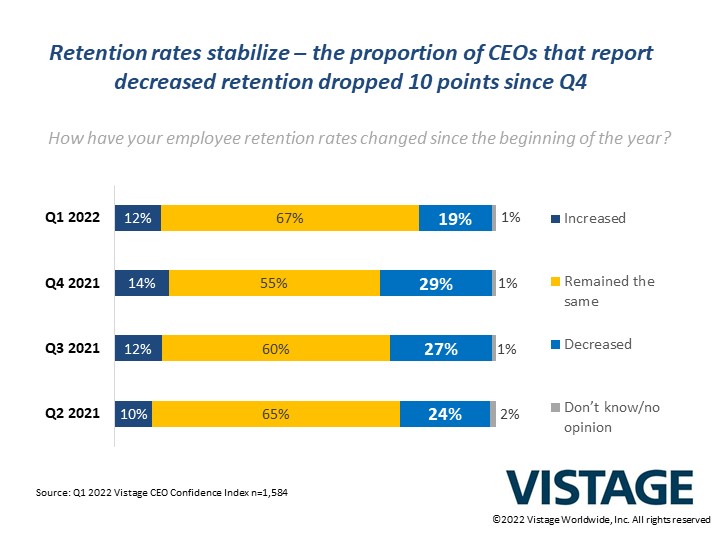

Retention rates, the “canary in a coal mine” for small and midsize businesses, have suffered in the wake of widespread resignations.

The loss of any worker has an immediate impact on an organization’s performance and encourages other workers to think about their options. The news of a coworker leaving for 25% more compensation and a bigger title will reverberate through any organization, as will news of a coworker joining with higher compensation than existing employees.

In today’s uber-competitive talent landscape, CEOs recognize it takes longer and costs more to hire someone less skilled or qualified than it is to retain someone. Retention rates have slightly stabilized since 2021; the initial surge of resignations is over, and concerns about COVID-19 and the Russian invasion of Ukraine have slowed job changes.

Shifts in supply and demand

Following the Great Recession, there was a shortage of jobs and an abundance of available workers. CEOs could be picky about who they hired and who they kept because the high-quality talent was readily available. They could also manage wages and performance while the economy steadily grew.

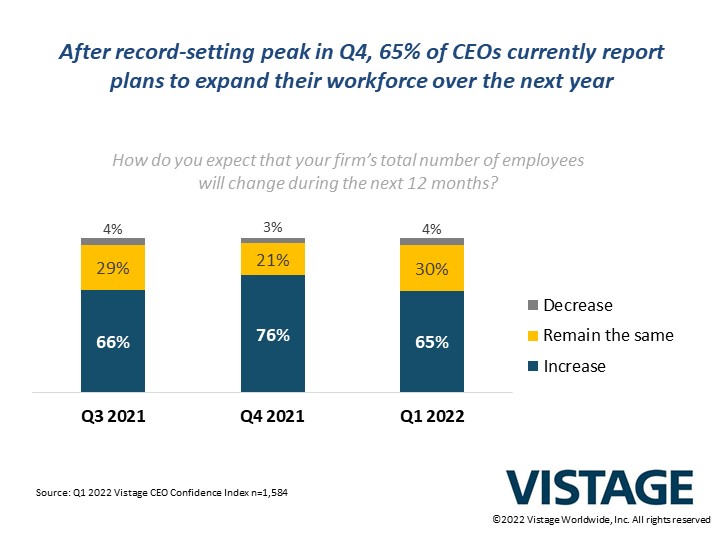

By the start of 2020, however, the reverse was true. After 10 years of workforce expansion, demand exceeded supply. At that time, 63% of CEOs planned to increase their headcount in 2020 according to the Q4 2019 Vistage CEO Confidence Index survey.

After COVID-19 emerged, though, those plans were temporarily halted until lost jobs were recovered during the rapid economic recovery.

Workforce expansion plans peaked to an all-time high during Q4 2021, with 76% of CEOs planning to expand their workforce in 2022 — coinciding with the peak of the quits rate. As of Q1 2022, 65% of CEOs still plan to increase headcount this year, despite hiring that took place in the first three months and growing economic concerns.

This indicates fierce competition for talent will continue as long as the predicted growth continues.

Hiring strategies

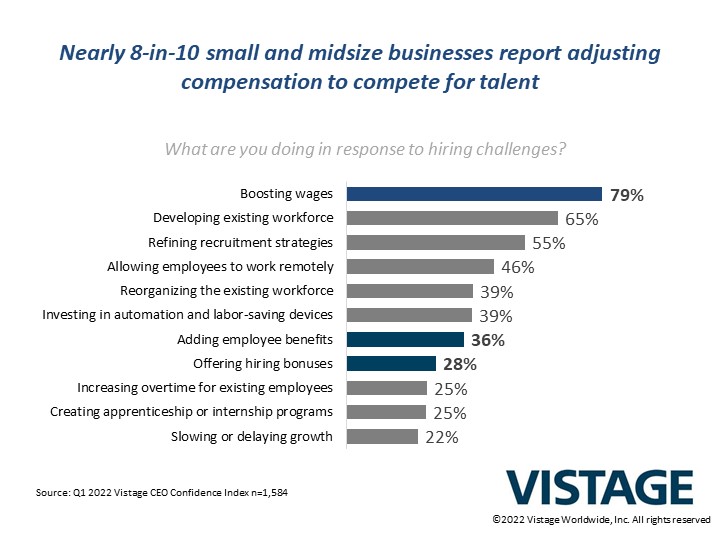

Compensation is at the heart of talent retention and acquisition strategy. Currently, 79% of CEOs are boosting wages to attract talent. Another 36% are adding employee benefits and 28% are offering hiring bonuses. However, to attract top talent and differentiate their organizations, CEOs must demonstrate they offer more than just a j-o-b.

Increasingly, CEOs recognize employee development is key, with 65% investing in this area.

A well-rounded employee development program — which includes career development, company culture training, soft-skills training and wellness activities — is valuable in several respects. It increases the productivity, performance and value of existing employees.

It improves retention rates, as employees are less likely to leave a company that actively invests in their personal and professional development. And it attracts prospective employees to an organization.

When the pandemic first hit, remote working seemed like a temporary fix. Now, it looks like a permanent fixture in many small and midsize businesses. Recognizing that many employees prefer to work from home, nearly half (46%) of CEOs are providing remote work options.

Investments in automation are also on the rise as CEOs look to improve productivity. These investments aren’t intended to replace people; rather, they are designed to improve worker productivity.

For example, companies are spending on improvements to customer engagement applications and access to information workstations for the home office. The next wave of technology will release the next surge in productivity and performance.

Accelerated evolution

COVID-19 triggered behavior changes that continue to play out in real-time. Today, the quits rate remains high, everyone is still in hiring mode and workers continue to flex their muscles to get higher wages with better working conditions.

With economic growth projected through 2026, demand for talent will only increase and exacerbate the talent wars.

Even before the pandemic struck, the Millennial and Gen Z workforces were asserting their need to be part of a strong company culture that connects to their values and principles. These needs, which companies set aside during the panic of the pandemic, are further complicating hiring difficulties.

The still-developing workplace of the post-pandemic workforce will be very different from the one left behind. Instead of an MF95 workplace, employees will experience a more adaptable, nimble environment that rewards performance over attendance and results over perception.

Most work will be done out of sight, and leaders and managers will need to recalibrate their performance management capabilities, adapt how they lead and change how they hire talent.

With these adjustments, organizations can capitalize on the productivity generated by an empowered and motivated workforce.

Related resources

Category: Talent Management

Tags: Hiring and Retention, talent management, talent planning, The CEO Pulse