Mergers & Acquisitions Trends for 2022

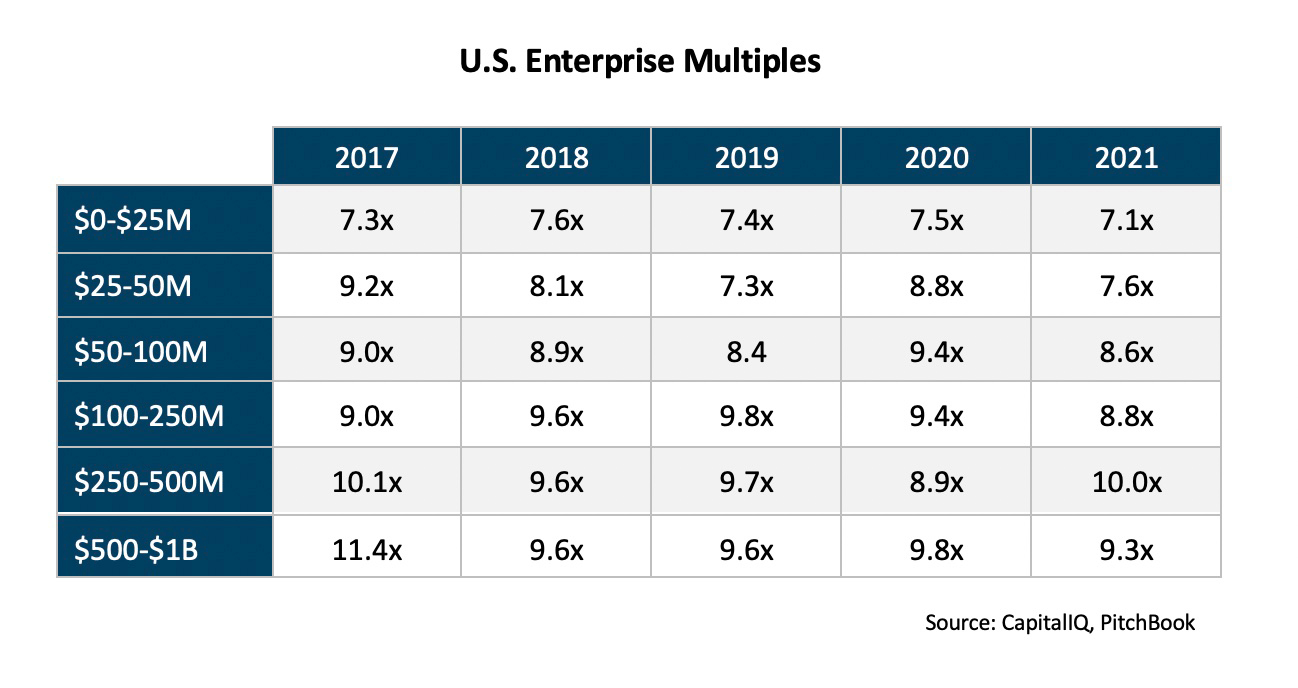

Coming out of the pandemic, it seemed that private company valuations would continue their meteoric rise.

Mergers and acquisitions were supported by a perfect storm of historically low-interest rates, mounds of private equity dry powder, and the revival of the U.S. economy.

Yet enterprise multiples in the middle market slid in Q4 and fell even further in Q1 of 2022.

Geopolitical factors ranging from rising interest rates, the uncertainty prompted by the Russian invasion of Ukraine, supply chain shocks and labor shortages have cast a shadow on the market. Public markets remain highly volatile.

But there are more fundamental changes to M&A underfoot, and short-term fluctuations don’t tell the story of a market in flux.

U.S. total deal volume grew from 1.75 trillion in 2020 to 3.07 trillion in 2021 but began to cool in Q4.

There are many factors impacting the market:

- A recent Deloitte study found that of potential sellers, only 37% identified strategic buyers as the most likely buyers for their businesses, down from 52% in 2019. i

- Strategic buyers no longer pay a significant premium over financial buyers but still represent the lion’s share of deals.

- Traditional buy-sell agreements are being disrupted by new business combinations and alternative transactions. 53% of respondents have “restructured,” including changes to working capital, reorganization, cost reduction and legal entity changes.

- The underlying dynamics of private equity are shifting. 2021 was the year of the SPAC (special purpose acquisition companies). SPAC activity tripled in 2021, with 574 SPACs chasing deals at the end of the year.

- In Q4, U.S. private equity firms had over $800 billion in “dry powder” on the sidelines. ii

- Speculative fever after the pandemic has cooled.

- A stringent regulatory environment is sparking more volume as providers seek ways to exit or become compliant.

- Public market valuations are inverted, with multiples for smaller companies often higher than larger companies, in part driven by some technology companies (such as FinTech) that are trading based on multiples of revenue and not EV/EBITDA multiples.

- There is movement toward ESG (environmental and social governance) considerations, being weighed by buyers and sellers.

Macroeconomics are highly uncertain, including:

- A resilient COVID-19 pandemic, with new shutdowns in China and fear of new strains.

- The Fed accelerating rate increases faster than at any time in history.

- Supply chain shocks — which were a function of spiking demand during the pandemic — being amplified by a sudden lack of supply. Sanctions on Russia will be hard to unwind. Inflation will likely continue, and a form of “stagflation” may be our new normal. Many analysts predict a recession in 2023.

- The resulting run-up in energy prices.

- No slowing of the hot labor market. Companies are changing their entire business models to minimize the need for labor. It’s common for acquirers to buy other companies to access their talent.

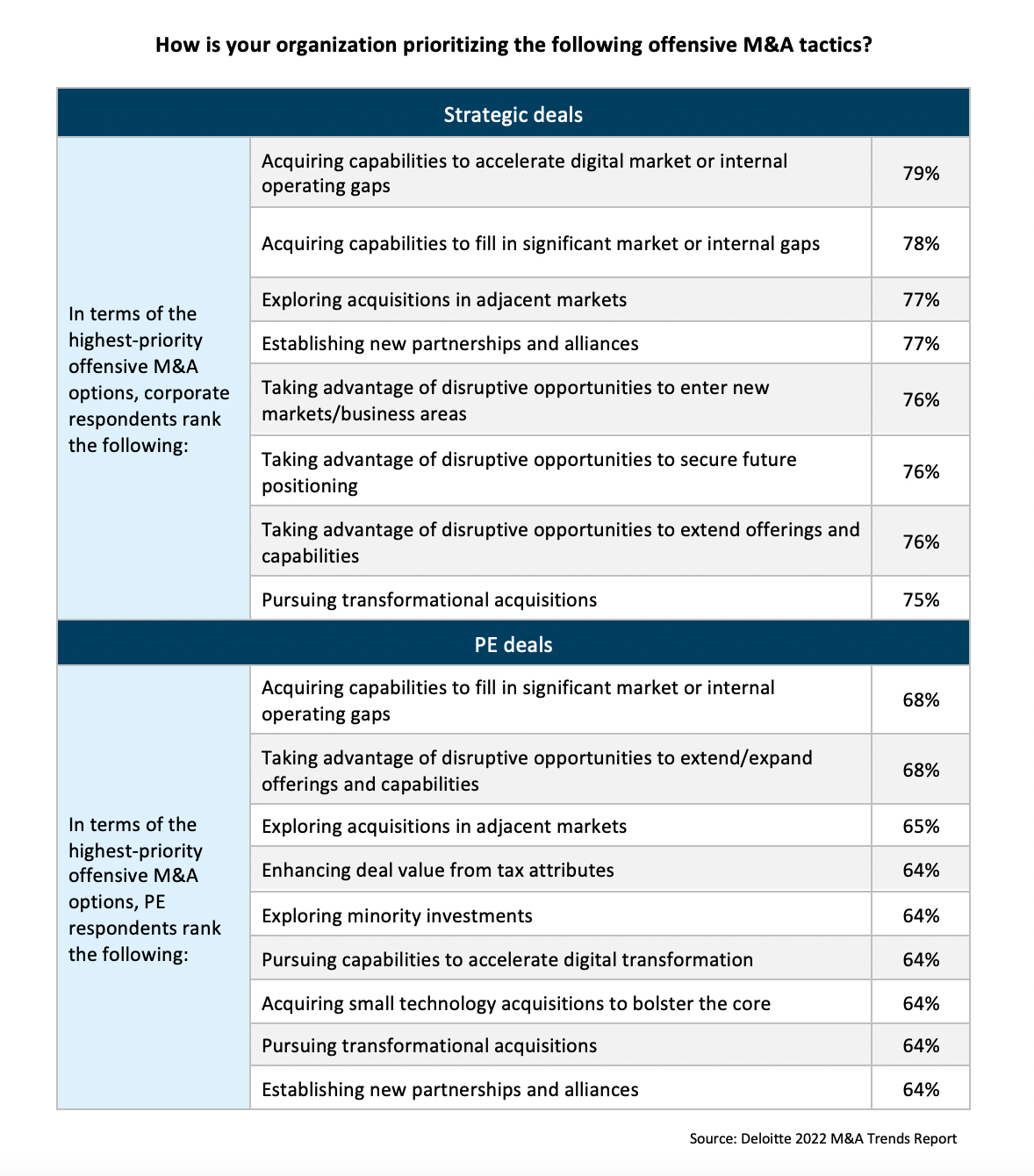

This frames a fascinating backdrop for the future of M&A. The number one motivation for strategic buyers today is to accelerate digital transformation.

Conversely, the number one motivation for financial buyers (PE) is to fill gaps in the market or internal gaps — perhaps a signal of continued emphasis on developing portfolios in specific industries (roll-ups). Strategic buyers are more likely to enter strategic partnerships, which can represent new capabilities, such as a deal between Uber and Spotify.

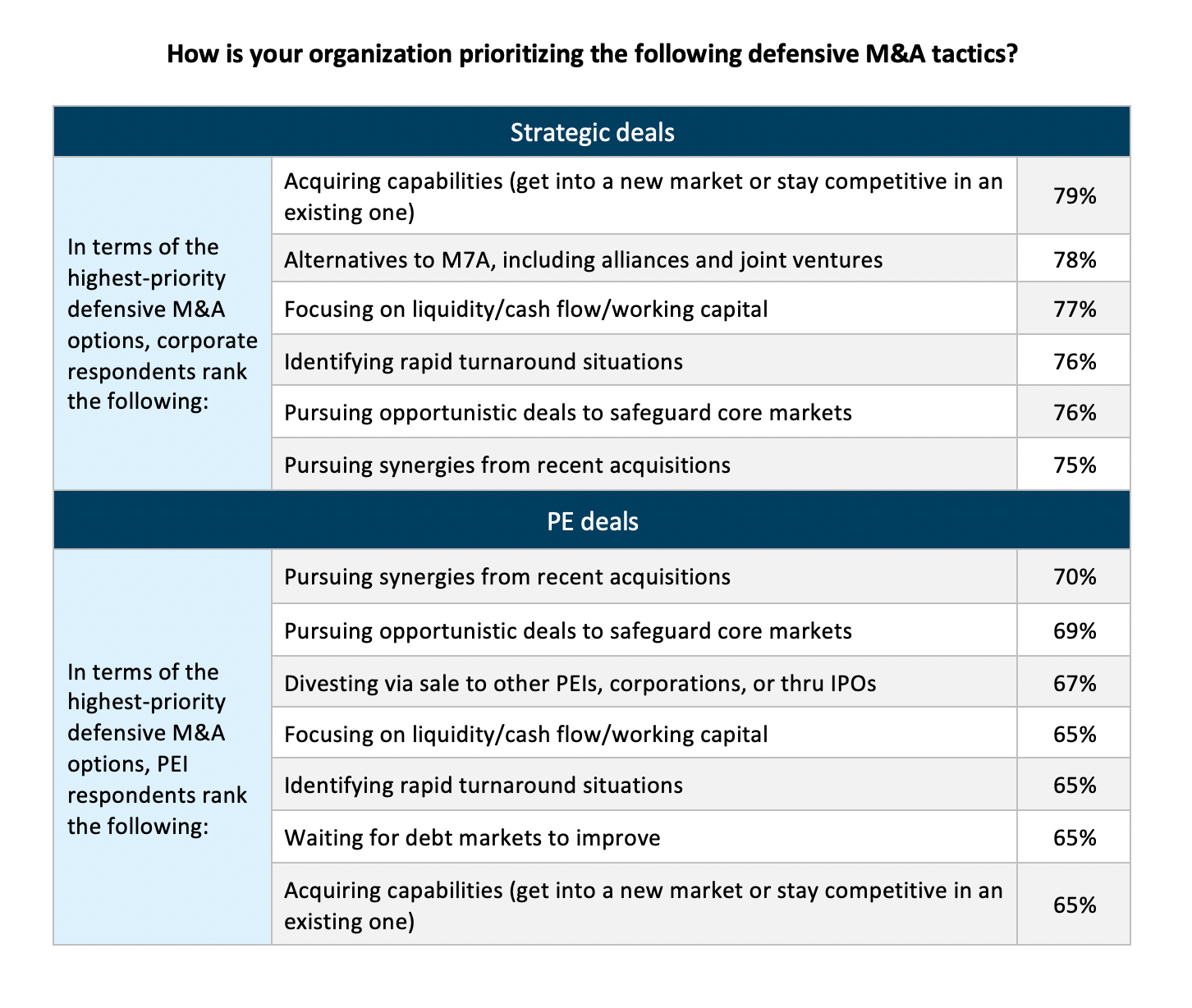

The top defensive tactic among strategic buyers is expanding capabilities in existing markets. This is part of a seismic shift of the last few years, as companies have shifted toward vertical integration and other methods of rounding their offering and controlling supply.

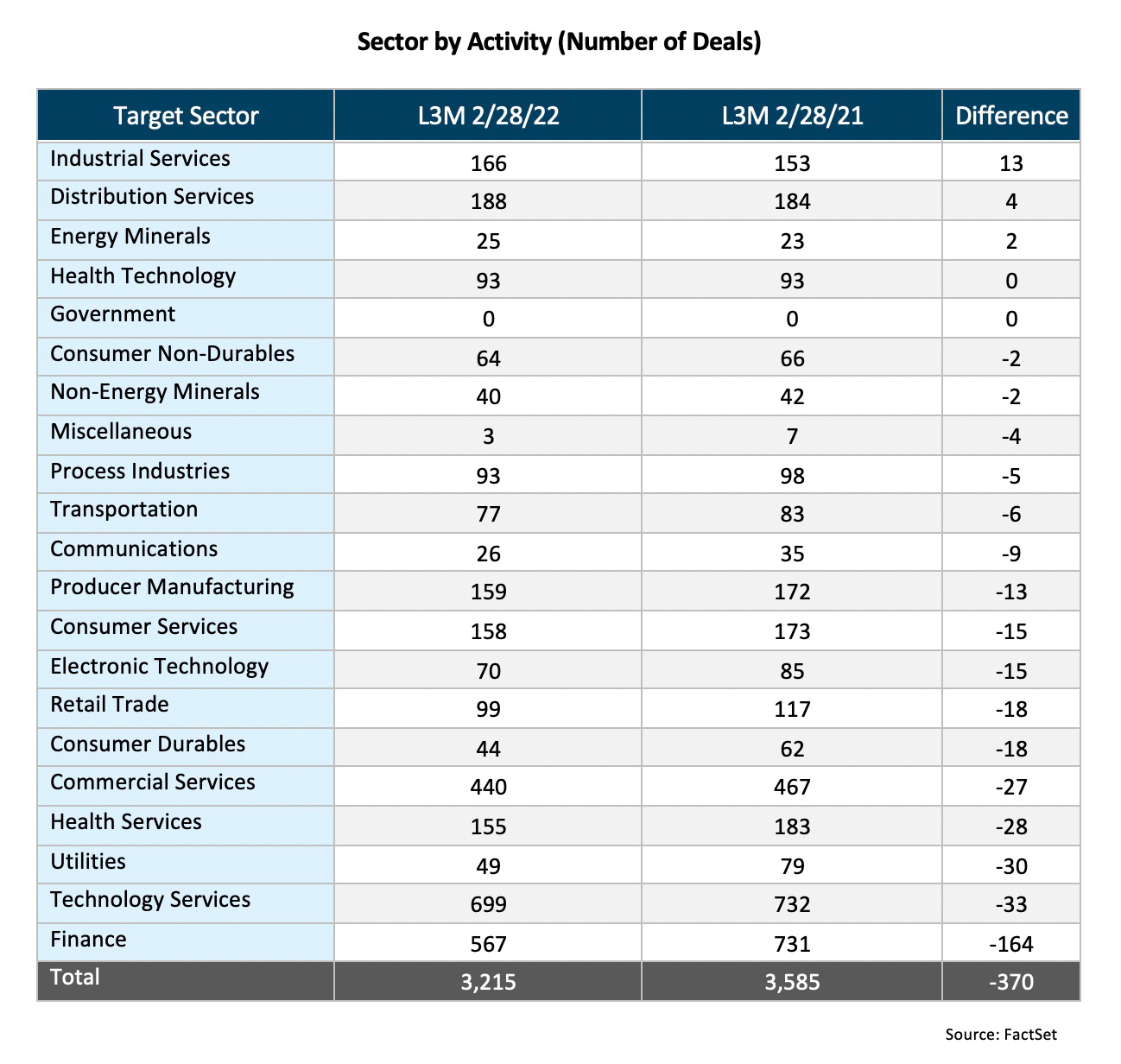

Finance and technology deal flow has cooled. Technology as a sector does not perform as well in periods of higher interest rates, given its high level of CapEx investment. Energy and mining have fared better.

The uncertainty of the socioeconomic climate will make for a dicey period ahead.

Buyers and sellers will have to cope with new realities and be thoughtful in determining valuations. It is hard to rationalize high multiples in a market fraught with risk.

For more information on how to value your company, see CB Insights.

i Deloitte 2022 M&A Trends Report

ii Eaton Square

Related Resources

The 7 key actions to maximize your business value

7 common mistakes made by sellers in mergers and acquisitions

Trends facing business in 2022 and beyond

Category: Economic / Future Trends

Tags: economic forecast, economic indicators, mergers and acquisitions