Freefall of small business confidence tempered [WSJ/Vistage July 2022]

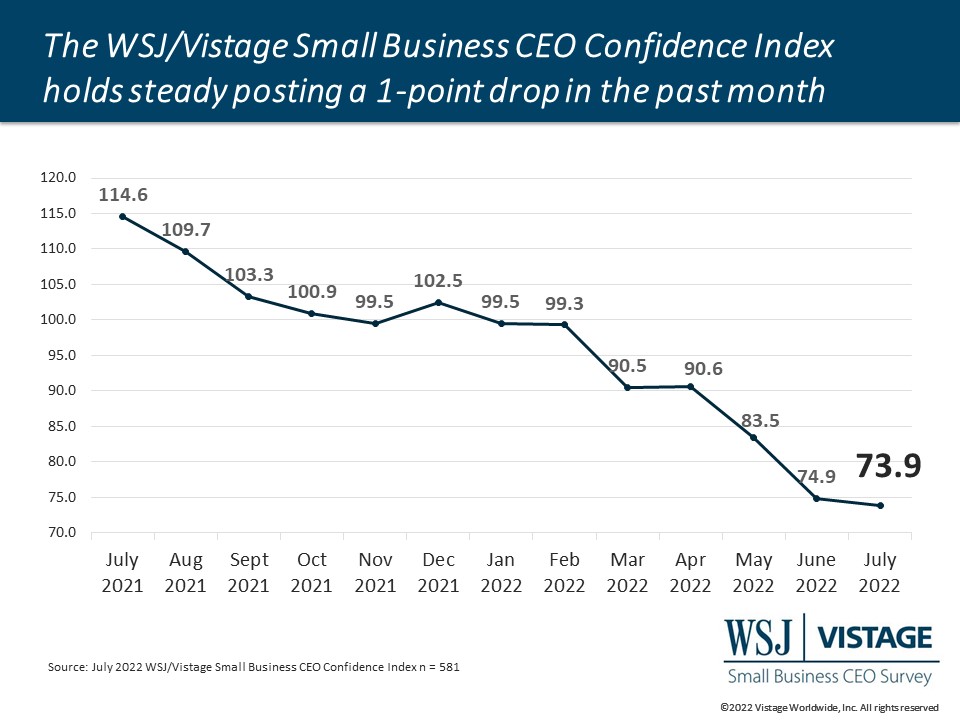

One of the most hotly contested headlines is whether the decline in the second quarter GDP numbers indicates that we are in a recession. And certainly, if you define a recession solely by 2 quarters of negative GDP growth, the 1.6% decline indicates that it might already be here. As a predictor of GDP, the declines in the WSJ/Vistage Small Business CEO Confidence Index since the beginning of the year were leading indicators of the downward trend in GDP. But the freefall we saw in the last two months stopped in July with the Index sliding just one point from June.

A recession is not always defined by GDP alone. Many economists — and Treasury Secretary Janet Yellen — have noted that employment has maintained a more optimistic measure. The latest job numbers revealed that unemployment remains at 3.6% and jobs continue to be added albeit at a slower pace. Our research shows similar optimism. Small businesses are adding to their workforce, with over half (52%) of them expanding the workforce in the next 12 months, while others that are maintaining their workforce size (39%) still need to hire just to maintain levels. Looking ahead, hiring plans remain strong with nearly three quarters staying the course with their 2022 hiring plans; 16% plan to hire more than planned and just 12% are hiring less. This indicates that despite the declining confidence in the economy since the beginning of the year, hiring plans remain strong.

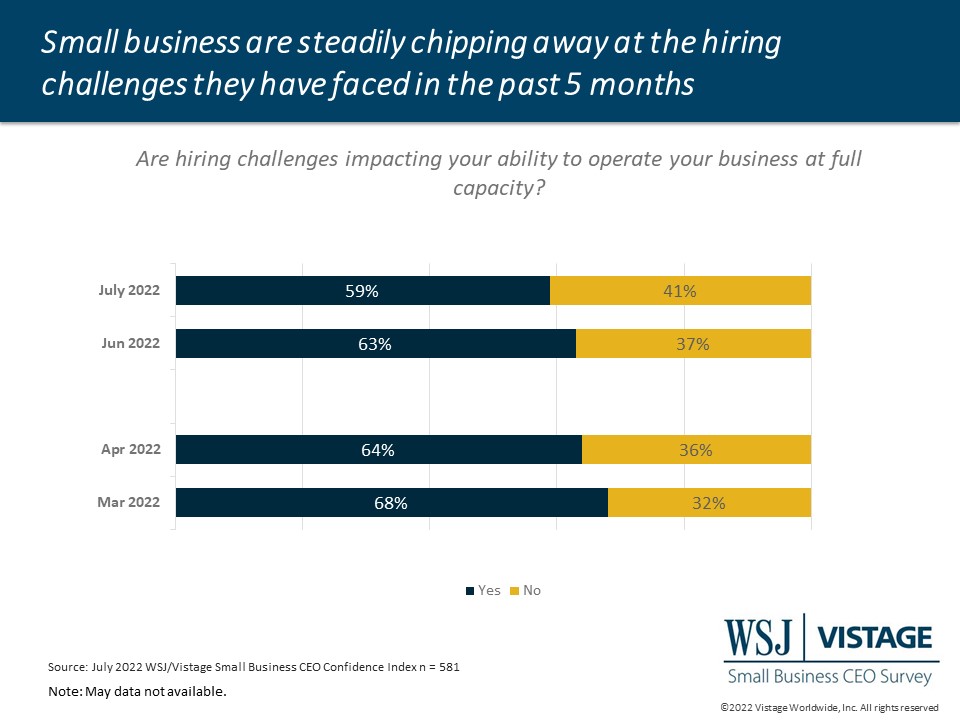

Another bright spot is that capacity challenges continue to improve. Since March, the proportion of small businesses that are having challenges operating at full capacity has dropped from 67% to 59% in the July survey.

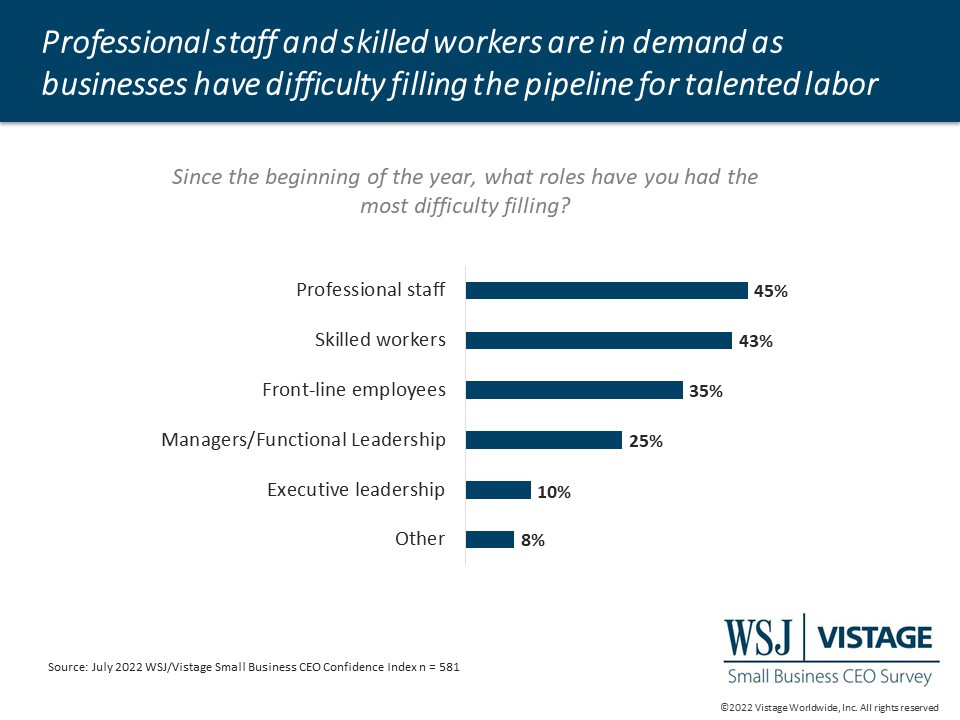

Hiring still a challenge, especially for professional and skilled workers

While overall hiring remains a challenge — nearly one-third report it is more difficult to fill positions than at the beginning of the year — specific roles present a bigger challenge than others. Professional staff and skilled workers are most difficult to find, and for good reason. These positions require skills and experience while frontline roles can be hired quickly and trained for their new positions. The workplace model might be a driving factor in these challenges to hiring professional staff as remote options are more likely to be offered to professional staff creating steeper competition.

July Highlights:

- The WSJ/Vistage Small Business CEO Confidence Index posted a marginal decline, reaching 73.9 in July.

- Employee development and leadership development are top ways that CEOs are addressing hiring challenges

- Supply chain challenges are easing, posting a 10-point improvement from last month

Download the July report for complete data and analysis

For a complete dataset and analysis of the July WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD JULY 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD JULY 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The July WSJ/Vistage Small Business CEO survey was conducted July 11-18, 2022, and gathered 581 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our next survey will be in the field August 8-15, 2022.

Related Resources

Category: Economic / Future Trends

Tags: Hiring, inflation, WSJ Vistage Small Business CEO Survey