Small business confidence rises over improving profit expectations [WSJ/Vistage Sept 2022]

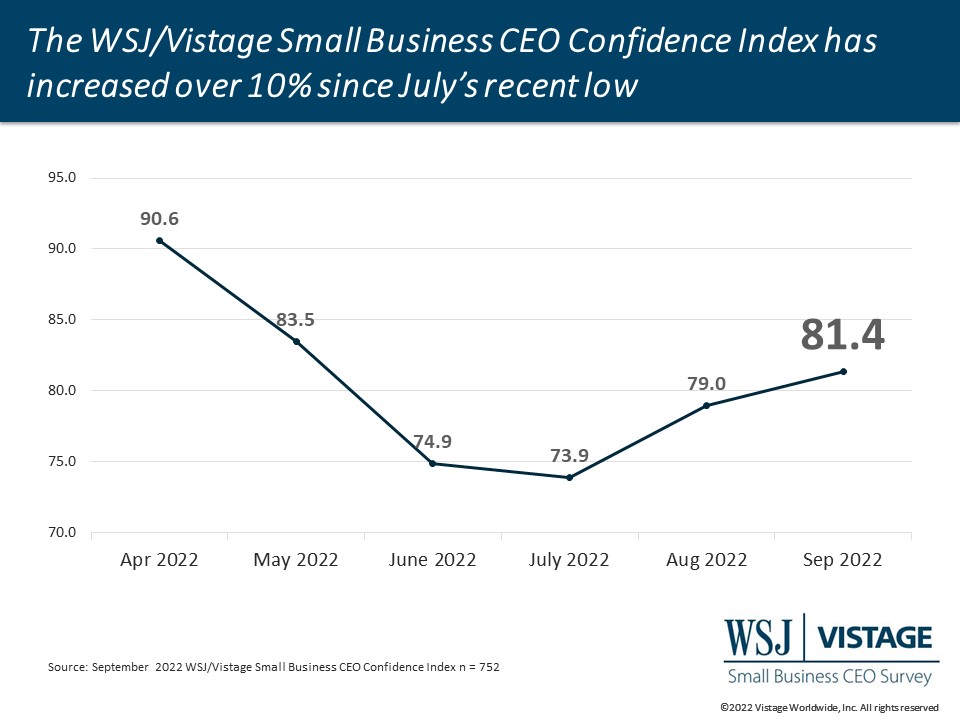

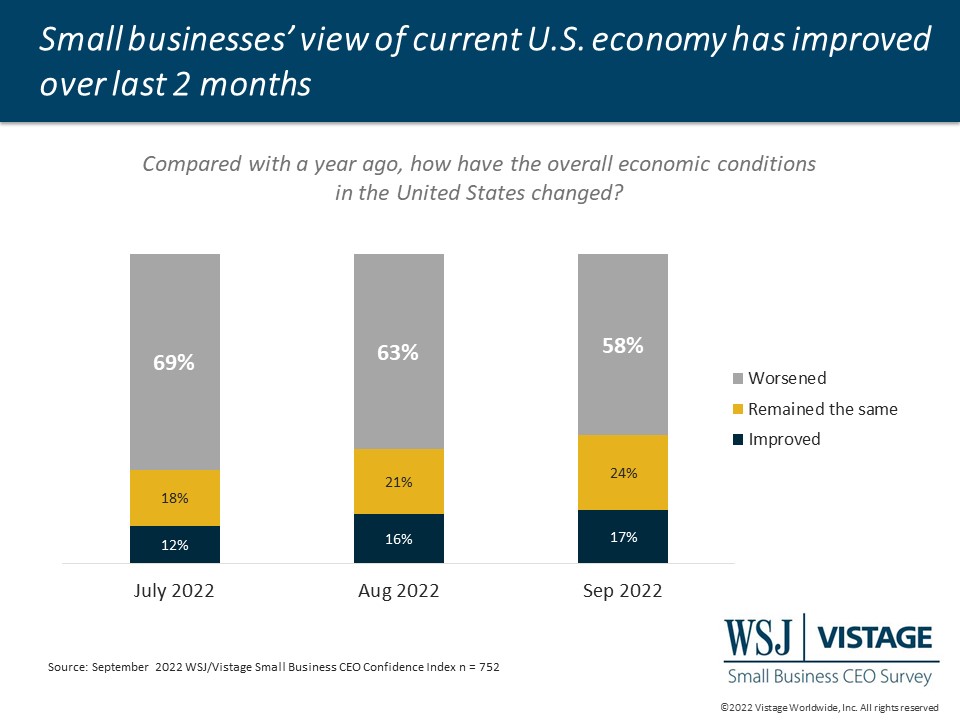

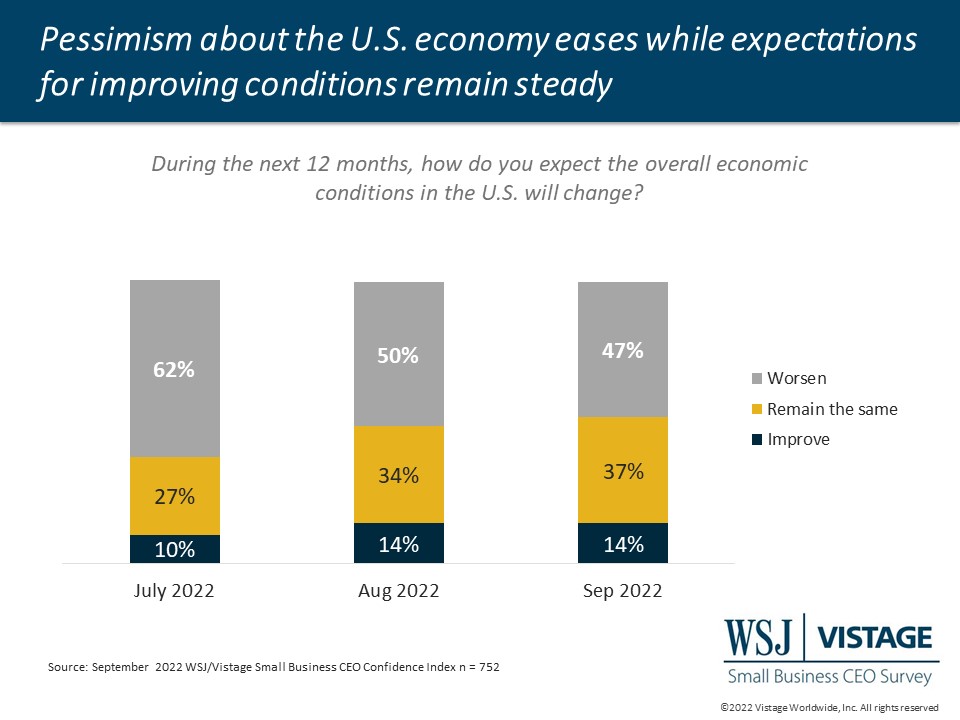

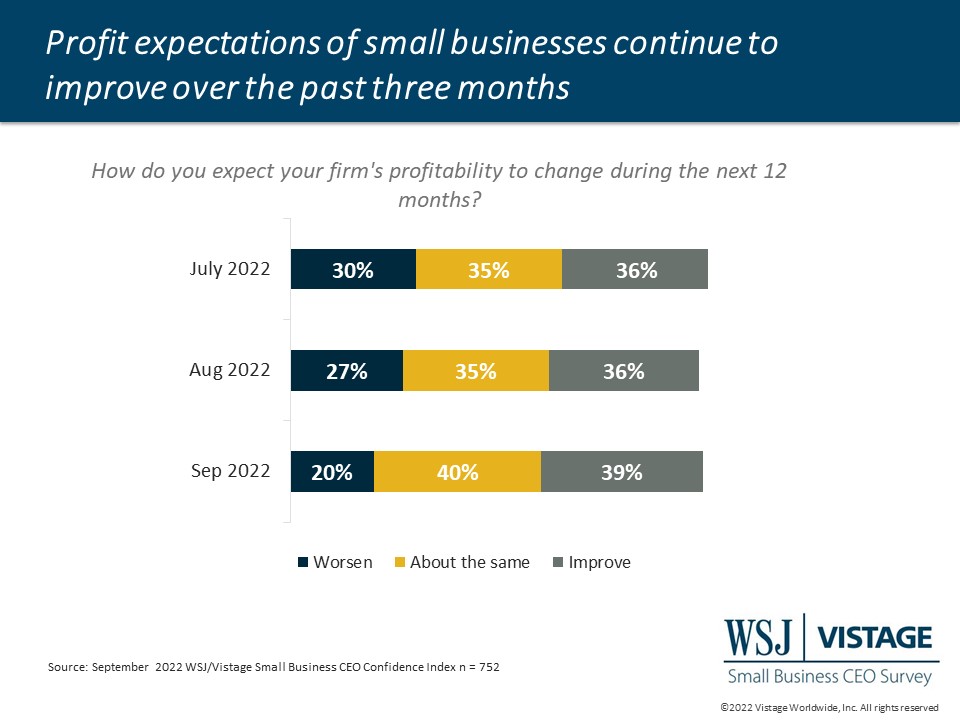

For the second month, the WSJ/Vistage Small Business CEO Confidence Index rose, continuing the climb from the recent low reached just 2 months ago. Sentiment about the economy continued to improve among small businesses, though not at the same pace as last month. The biggest driver of the monthly increase was the improvement in profit expectations. While the proportion of small businesses that expect improved profits grew to 39%, more significant is that just 20% expected profits to worsen, down from 27% last month and 30% two months ago.

What’s driving this improvement?

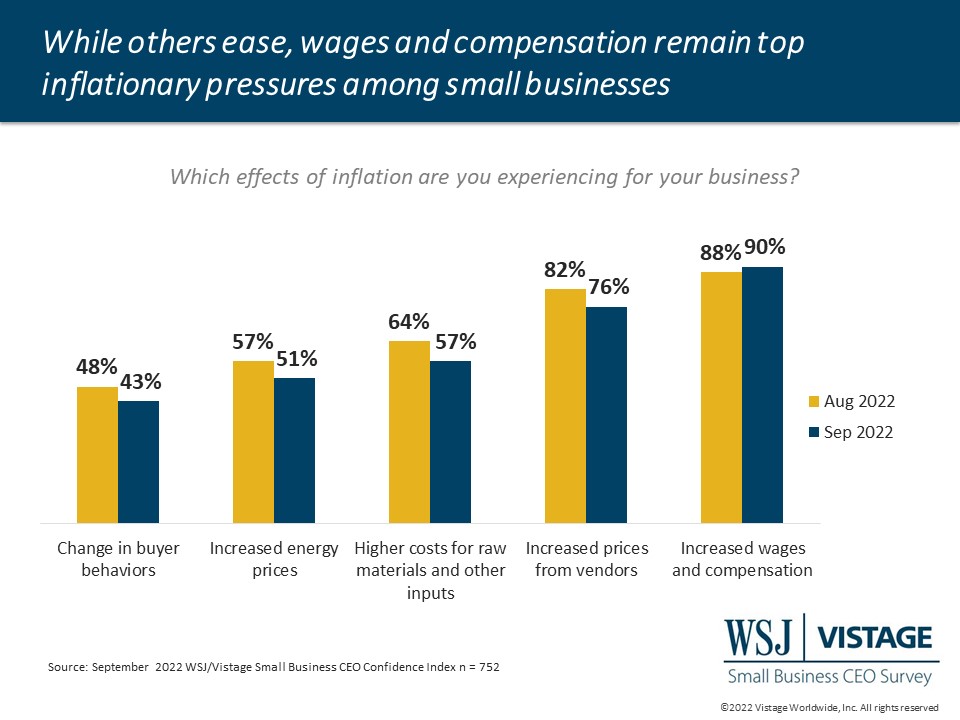

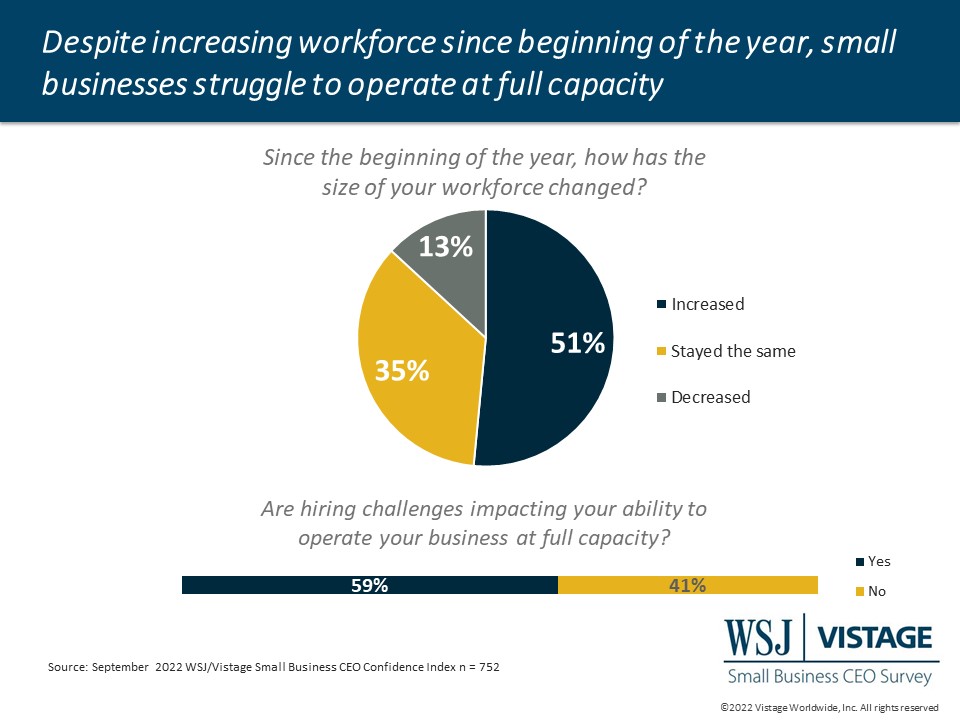

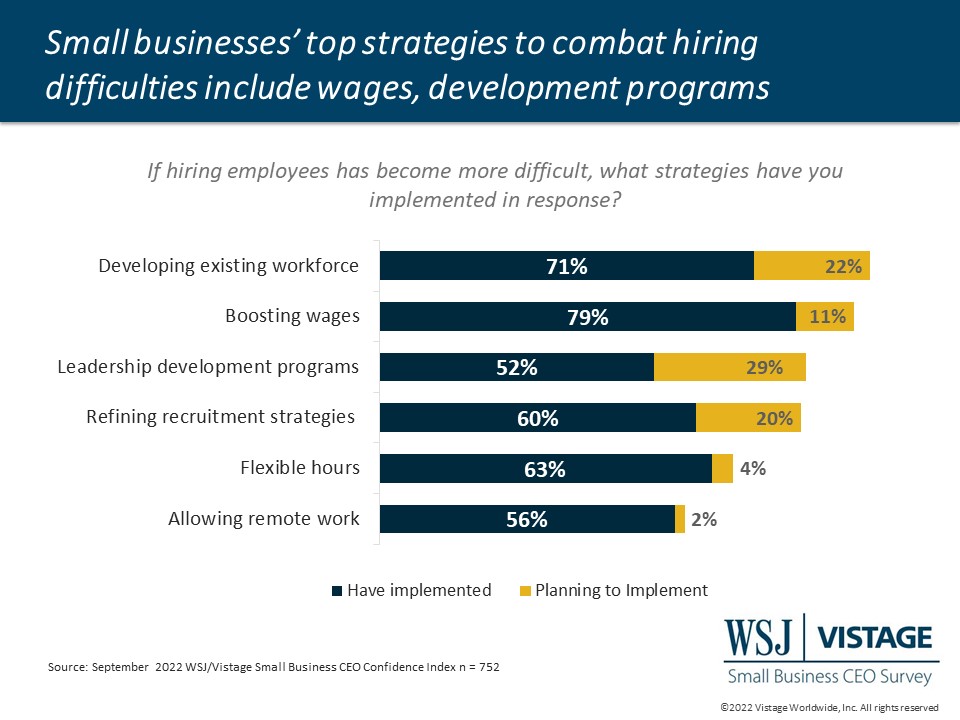

Rising wages remain blurred between an inflationary impact and a competitive hiring tactic. Wage pressures are reported by 90% of small businesses, up marginally from last month. The tight labor market remains a big contributor to rising wages; 79% of small businesses report boosting wages in response to hiring challenges and another 11% plan to raise wages in the future.

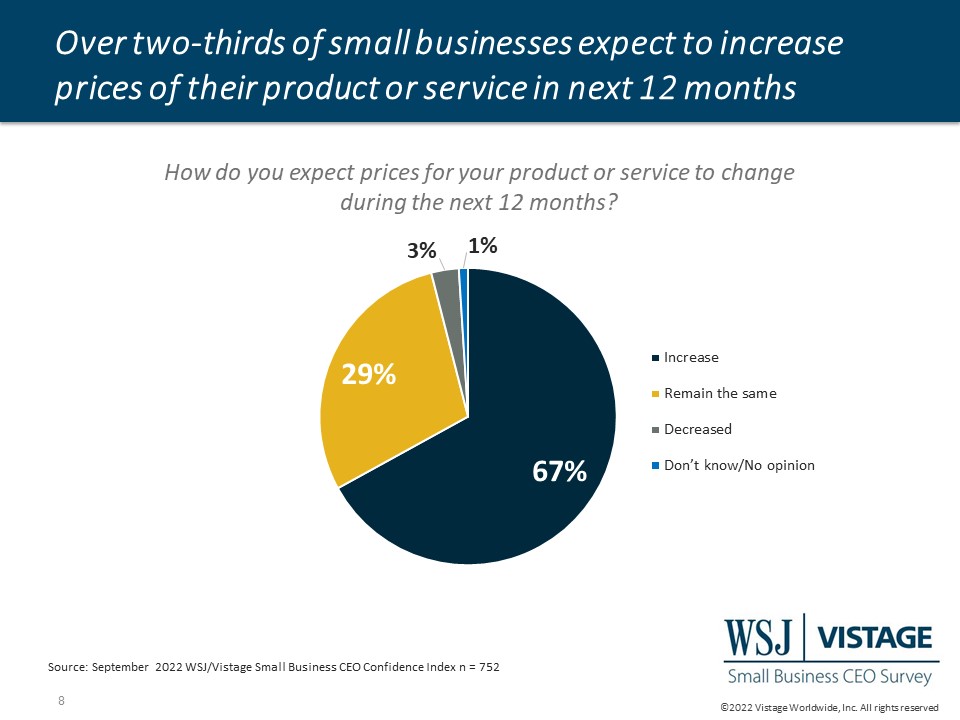

While there is no relief from wage pressures in sight, looking deeper into inflationary pressures we see some easing, especially for those who are supply chain dependent.

- The proportion of small businesses impacted by higher costs for raw materials and inputs dropped 7 points from last month, reaching 57%.

- Energy prices are also easing, impacting 51% of small businesses, which is down from 57% last month. Just as consumer sentiment rose as gas prices decreased, small business confidence followed suit

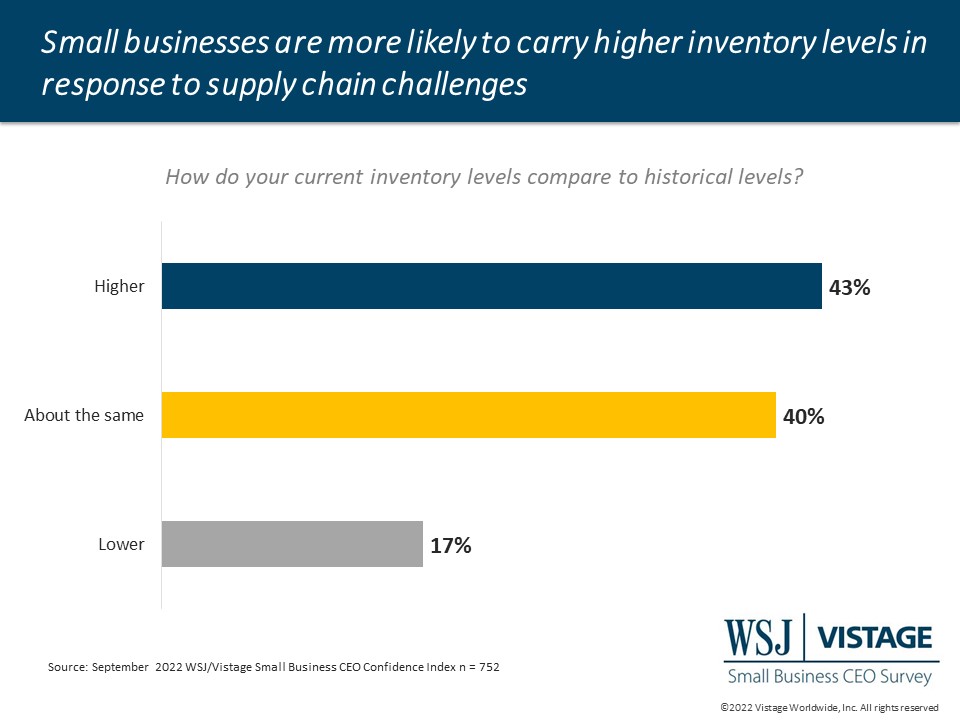

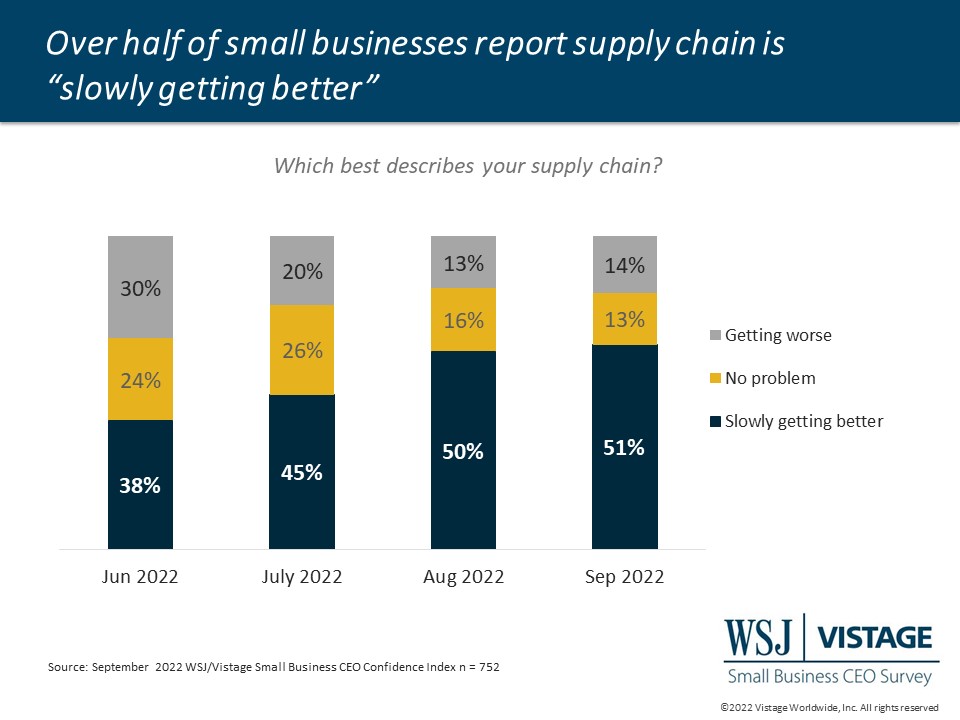

Solving supply chain with inventory

While 51% report that the supply chain is slowly healing, one way small businesses are addressing supply chain challenges is carrying higher inventory levels. Of those small businesses surveyed that carry inventory, 43% report higher inventories than historical levels, and 40% report similar levels. However, even with inventory that is on par with prior levels, it’s important to note that due to rising costs, the inventory’s value is greater in dollars, noted one respondent, adding, “it’s currently higher than historically.”

While there is a risk in holding higher inventory levels, there is also a competitive advantage. Ordering in larger quantities may result in cost discounts. Higher inventory levels may shorten the time to fulfill orders or simply help keep projects and orders on track. As one respondent noted, “Moving to higher inventory levels had been strategically important, and we are picking up market share because of these investments.”

While the proportion of small businesses reporting changes in buyer behavior has declined 5 points from last month, 43% of small businesses note inflation is changing buyer behavior, inclusive of slowing demand, smaller budgets, increased rigor and longer sales cycles. Monitoring demand and managing inventory accordingly will be a delicate balance over the coming months.

September Highlights:

- The WSJ/Vistage Small Business CEO Confidence Index rose for the second month in a row.

- Profit expectations improved from last month; 39% of small businesses expect improved profits

- Economic sentiment continues to improve among small businesses; an 11.3% improvement in the perception of the current economy and a 4.7% improvement in future economic conditions.

Download the September report for complete data and analysis

For a complete dataset and analysis of the September WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD SEPTEMBER 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD SEPTEMBER 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The September WSJ/Vistage Small Business CEO survey was conducted September 7-14, 2022, and gathered 752 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our next survey will be in the field October 3-10, 2022.

Related Resources

Category: Economic / Future Trends

Tags: inventory forecasting, profitability, supply chain, WSJ Vistage Small Business CEO Survey